Your worldwide news source for mortgage, real estate, and financial news.

A monthly report shows the number of foreclosed homes in the Phoenix area edged up again last month, hitting the highest percentage of total sales since January. The Arizona State University Realty Studies report shows foreclosures made up 43 percent of the existing homes sold in July.

In June that number was 36 percent and in May, it was 33 percent. ASU real estate professor Jay Butler says the actual number of single-family home foreclosures was about 3,900, close to June’s numbers.

In July 2009, 4,200 homes were lost to foreclosures. Besides homes lost to foreclosure, 5,100 existing homes sold in Maricopa County in July, down from 6,900 in June and 7,300 in July 2009. That number includes homes previously repossessed by banks and then resold.

The Associated Press august 12, 2010

In an acknowledgment that the foreclosure crisis is far from over, the Obama administration on Wednesday pumped $3 billion into programs intended to stop the unemployed from losing their homes.

The housing market, which usually helps lead the country out of a recession, is this time helping hold the recovery back. Interest rates are at record lows, but too few can afford to buy or refinance. Unemployed homeowners who live in communities where values have fallen sharply are often unable to sell. Their foreclosures weaken neighborhoods and create a vicious circle by further undermining the market.

To try to break this pattern, the Treasury Department said it was adding $2 billion to its Hardest Hit Fund, roughly doubling its size. The fund, first announced by President Obama in February and expanded in March, goes to housing finance agencies in various states to create local aid programs.

Most of the state programs from the first two rounds are barely under way, but Treasury officials said it was clear that more funds were needed. “In this very deep recession, people have tended to be out of work a little longer,” Herbert M. Allison Jr., assistant secretary for financial stability, said. “That’s why we think this additional relief for people searching for a job is so important.” The second program, announced by the Department of Housing and Urban Development, will draw on $1 billion authorized by the new financial overhaul law.

The agency said it would work with local aid groups to offer bridge loans of up to $50,000 to eligible borrowers to help them pay their mortgage principal, interest, insurance and taxes for up to 24 months. The loans will be interest-free. Until now, the Hardest Hit Fund had been projected to help about 140,000 borrowers. Treasury officials said that number would grow with the new infusion of money, but offered no estimate. HUD also did not say how many homeowners would be eligible for its program.

If the new money is spent in the same way as the previous money, both programs would eventually aid about 400,000 borrowers — a large number, but not when set against the 14.6 million unemployed or three million contemplating foreclosure. Over the last two years, the government has deployed many programs to help housing. It pushed interest rates down, offered tax credits and set up an ambitious mortgage modification program. Yet housing remains feeble and seems poised after a brief respite this year to become weaker again. “I think all these government programs are helpful, but I wouldn’t look for them to cure the recession or even what ails housing,” said the economist Karl E. Case. “At best, they’re preventing things from getting much worse.”

The Hardest Hit Fund will draw on the $45.6 billion set aside for housing in the Troubled Asset Relief Program, the rescue measure begun at the height of the financial crisis in the fall of 2008. Initially, the fund gave $1.5 billion to five hard-hit states: Arizona, California, Florida, Michigan and Nevada. The second round in March of $600 million went to North Carolina, Ohio, Oregon, Rhode Island and South Carolina.

The expanded list of states eligible for the latest funding includes Alabama, Illinois, Kentucky, Mississippi and New Jersey, as well as the District of Columbia. Each state’s share of the money is based on its population. Many of the programs involve direct assistance. Ohio, for instance, said it would use its $172 million to aid 15,356 homeowners by helping bring delinquent mortgages current for owners experiencing hardship because of a loss of income. The assistance will last up to 12 months.

The other housing money in the Troubled Asset Relief Program is earmarked for the modification programs ($30.6 billion) and a Federal Housing Administration refinancing program ($11 billion). The administration can shift money between the programs only until Oct. 3, the two-year anniversary of the program. HUD said it was in the process of determining which communities would receive its money and how exactly the process would work.

“We’re still in the design phase,” said Bill Apgar, HUD senior adviser for mortgage finance.

by David Streitfeld New York Times august 11, 2010

by Adam Quinones on June 23, 2010

Fannie Mae announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure.

Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure.

“We’re taking these steps to highlight the importance of working with your servicer,” said Terence Edwards, executive vice president for credit portfolio management. “Walking away from a mortgage is bad for borrowers and bad for communities and our approach is meant to deter the disturbing trend toward strategic defaulting. On the flip side, borrowers facing hardship who make a good faith effort to resolve their situation with their servicer will preserve the option to be considered for a future Fannie Mae loan in a shorter period of time.”

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

Troubled borrowers who work with their servicers, and provide information to help the servicer assess their situation, can be considered for foreclosure alternatives, such as a loan modification, a short sale, or a deed-in-lieu of foreclosure. A borrower with extenuating circumstances who works out one of these options with their servicer could be eligible for a new mortgage loan in three years and in as little as two years depending on the circumstancesHere is the verbiage from the FN Bulletin:

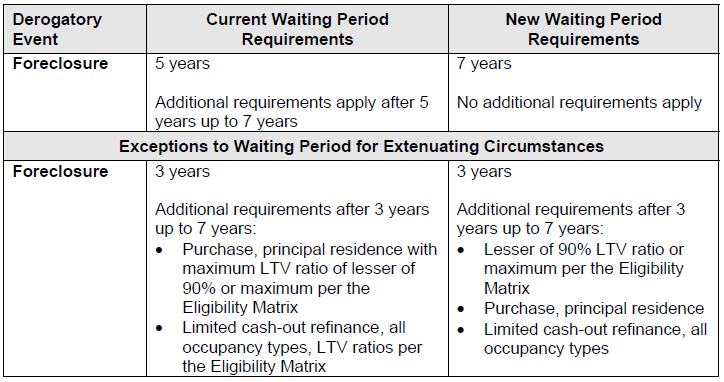

Currently, the waiting period that must elapse after a borrower experiences a foreclosure is seven years. However, Fannie Mae allows a shorter time period – five years – if certain additional requirements are met (e.g., minimum down payment and credit score, and occupancy requirements).

These requirements are being modified to remove the five year option. Unless the foreclosure was the result of documented extenuating circumstances, which only requires a three-year waiting period (with additional requirements), all borrowers will now be required to meet a seven-year waiting period after a prior foreclosure to be eligible for a new mortgage loan eligible for sale to Fannie Mae“

Don’t miss the section that says borrowers who have extenuating circumstances may be eligible for new loan in a shorter timeframe.

by J. Craig Anderson The Arizona Republic Jun. 24, 2010 12:00 AM

A small number of Arizona homeowners facing foreclosure could receive significant aid - reducing what they owe by $100,000 or more - under a state-run program approved Wednesday.

The Arizona Department of Housing got a green light from Washington, D.C., for a plan to use $125 million, its portion of federal funds allocated in February to help the nation’s hardest-hit housing markets.

Arizona’s program could slash mortgage balances for 1,850 households, three-fourths of them in Maricopa County.

The approach is far too small in scale to stabilize the state’s housing market, officials said. But they hope it will spur further action from government and lenders on cutting mortgage principal to keep homeowners in their homes. The plan would go much further than existing government efforts in its attempt to make mortgages affordable.

The state will issue borrowers loans of up to $50,000 to apply to their mortgage balances. Their lenders will be expected to match or exceed that amount.

These “soft” loans would not likely have to be repaid, at least not in full, under the terms of the plan.

Homeowners would have to repay portions of the loans if the home appreciated or was sold during a 10-year period.

The program also would:

• Give lenders incentives of up to $5,000 to settle second mortgages for up to 1,500 homeowners.

Those loans have complicated many borrowers’ attempts to modify their mortgage payments or complete short sales, in which they sell for less than what they owe but avoid foreclosure.

• Give up to $12,000 in temporary aid to as many as 1,000 households that have suffered reduced incomes.

The plan, dubbed “Save My Home AZ,” is expected to launch in September.

As a trial run for potentially broader mortgage-relief programs, state officials said, it will blaze into largely uncharted loan-modification territory.

“What we’re hoping is that, if it’s successful, Treasury would provide more funding for it,” said Carol Ditmore, the Housing Department’s assistant deputy director of operations.

But with as many as 50,000 foreclosures expected to occur in Arizona this year, Save My Home AZ’s direct impact would be minimal, officials said.

It also shares some of the drawbacks that have plagued other government-run housing-relief efforts. It imposes strict eligibility requirements, meaning many homeowners at risk of foreclosure won’t qualify for help.

And its biggest hurdle is that it relies on the optional participation of lenders to match the cuts in principal.

Big mortgage lenders including Bank of America, which holds a significant portion of Arizona’s troubled mortgages, have largely refused to reduce principal for borrowers seeking loan modifications.

MaryJane Rogers, spokeswoman for Chase Home Lending, a JPMorgan Chase & Co. subsidiary, said the company had not yet decided whether to participate in the Arizona program.

“We are committed to helping customers avoid foreclosure and are currently reviewing the details of the Arizona plan,” Rogers said.

Ditmore said the Housing Department has engaged in several discussions with BofA, the country’s largest mortgage lender, adding that bank officials have expressed their willingness to reduce loan principal for eligible participants.

BofA did not respond to phone and e-mail messages seeking comment Wednesday.

The program comes relatively late in the foreclosure crisis.

It is scheduled to conclude in June 2013, according to a proposal the state Housing Department submitted to Treasury officials earlier this year.

That’s around the time many housing experts expect foreclosure activity to return to a historically normal level.

The $125.1 million in funding is part of $1.5 billion in Treasury Department funds.

Shared with California, Nevada, Florida and Michigan, the funding is known as the State Housing Finance Agencies “Hardest Hit Fund.”

Treasury officials plan to distribute an additional $600 million to North Carolina, South Carolina, Ohio, Oregon and Rhode Island to help states with unemployment rates exceeding 12 percent.

by Maura Webber Sadovi The Wall Street Journal June 23, 2010

Billionaire investor and Microsoft co-founder Paul G. Allen has spent roughly two decades and millions of dollars amassing real estate, primarily in Seattle.

But last year, Mr. Allen’s Vulcan Inc. investment firm began intensifying its search for deals outside the Pacific Northwest, branching out into the beaten-down property markets of Southern California and Arizona.

Now that quest has yielded its first deal: Vulcan is paying $35 million in cash for an empty eight-story office building completed last year in downtown Tempe, Ariz. The transaction signals a two-pronged strategy change for Vulcan. The firm is both mixing more geographic diversity into its property portfolio and moving toward buying existing buildings rather than building from scratch, as the firm has typically done in the past.

Vulcan is known for ill-fated technology investments that fit into Mr. Allen’s earlier vision of a “wired world.” The firm lost enormous sums on investments in companies like Charter Communications Inc. But the firm also has invested large sums in real estate and a range of other asset classes.

Vulcan faces competition in its real-estate strategy because numerous other deep-pocketed investors have been chasing distressed real estate, while owners have resisted selling at today’s discounted prices.

“We’ve taken a run at a couple other assets,” Ms. Healey says. “There’s a tremendous amount of capital in the market.”

Mr. Allen, 57 years old, authorized the Tempe acquisition and took part in the decision to move into new markets such as Phoenix that Vulcan believes are poised for a rebound, Ms. Healey says. The Tempe Gateway building was built by Opus Corp.’s Opus West unit, which filed for bankruptcy protection last year. The sale was part of the bankruptcy process.The 260,000-square-foot building is on a main artery of Tempe near a light rail stop and close to Arizona State University. The building squares with Vulcan’s interest in urban infill locations close to public transportation, Ms. Healey says.

Vulcan, founded in 1986, is headed up by Mr. Allen’s sister Jody Allen. Firm officials say Vulcan’s real-estate portfolio is more than 95% leased and comprises more than $2 billion in assets in the Seattle area, where Mr. Allen is one of the city’s largest property owners. Vulcan owns nearly 60 acres of land in the city’s South Lake Union neighborhood. That also is where Vulcan scored one of its more recent real-estate wins: a deal to build a new headquarters complex for online retailer Amazon.com.

Vulcan has also made some missteps. In the 1990s, Vulcan built and helped finance the Rose Garden arena in Portland, Ore., home to Mr. Allen’s Portland Trail Blazers NBA basketball team. In 2004, the Vulcan affiliate that owned the arena filed for bankruptcy protection, and the Rose Garden was taken back by lenders, though Vulcan repurchased the arena in 2007. “There just weren’t a lot of very wealthy people willing to buy skyboxes,” says Randall Pozdena, managing director of ECONorthwest, an economic consultancy based in Eugene, Ore. A spokeswoman for Vulcan says the company treats the asset as a basketball asset, not real estate.

Betting on a Phoenix real-estate recovery is still something of a gamble. Tempe, part of the Phoenix metropolitan area and home to the corporate headquarters of U.S. Airways Group, has seen the vacancy rate of its Class-A office space soar to about 40% in the first quarter, including sublease space, from about 29% one year earlier, as the market has struggled to absorb newly constructed buildings, according to Cassidy Turley BRE Commercial, a real-estate-services firm in Phoenix.

Meanwhile, the average price paid for office space per square foot in Tempe fell to about $102 last year, from a peak of $265 in 2008, according to CoStar Group Inc., a real-estate-research firm. But Jim Fijan, an executive vice president with CB Richard Ellis who represented the group of lenders selling the Tempe building, said as many as eight local and national companies bid on the property. He estimates the building, acquired for about $135 a square foot, would cost about $225 a square foot to construct.

by Austen Sherman The Arizona Republic Jun. 17, 2010 12:00 AM

• Read the full economic report

After a recession, the nation’s Mountain West usually makes employment gains faster than the rest of the nation, analysts say.

That’s not the case this time.

According to a new report, the region’s slow economic recovery actually has weakened in some ways in the early months of 2010.

Metro Phoenix, along with Las Vegas and Boise, Idaho, remain behind the nation in the economic recovery, according to a June study produced by Brookings Mountain West.

Brookings’ Mountain Monitor report identifies a number of indicators of economic success and compares data for the region’s major metropolitan areas, as well as the average of the top 100 metropolitans in the United States.

While Ogden, Utah, Albuquerque and Colorado Springs appear to be back on their feet, for example, the Valley’s real-estate-based economy is struggling to rebound.

“What is more troubling for the West is this is the first major recession in which areas like Phoenix did not power out of the economic trouble quicker than the rest of the country,” said Mark Muro, fellow and policy director of the Metropolitan Policy Program at Brookings Institution.

Brookings Mountain West is a partnership between the Washington, D.C.-based Brookings Institution and the University of Nevada-Las Vegas. The Mountain Mirror report covers Arizona, New Mexico, Nevada, Colorado, Utah and Idaho.

In employment, economic growth and housing, both the region and Arizona lag, according to the study, which incorporates economic reports through March. Phoenix and Boise are among the hardest-hit metro areas in the nation for job loss, with employers slow to resume hiring. Home prices declined in every metro area in the region, and the number of lender-owned properties remains on the rise.

At first glance, the metro Phoenix data looks strong, with its total economic output ranking above the national average for the first quarter of the year. Its GMP, or gross metropolitan product, was up 1.2 percent from the fourth quarter of 2009. However, Phoenix ranks near the bottom nationally in overall loss of economic output since its GMP peaked in the fourth quarter of 2007.

But a major problem, the metro area’s inability to create new jobs, remains. Since its employment numbers peaked in the third quarter of 2007, metro Phoenix has lost 11.9 percent of its jobs, ranking eighth-worst out 100 metro areas nationally.

“Jobs are the big struggle nationally and in Arizona,” said Dennis Hoffman, economics professor and director of the L. William Seidman Research Institute at Arizona State University. “The real challenge with job creation stems from the fact that businesses have learned to get by with fewer people.”

Many of the reasons for the slow recovery have been well-documented. With an economy based largely on growth and real estate, the Valley was left with little else when the housing bubble burst, followed by the financial meltdown. Real-estate and construction jobs disappeared, followed by jobs at businesses that fed off the industry.

“You had this really traumatic real-estate explosion, and the collateral damage of people’s homes being underwater really hurt their ability to spend,” Muro said.

Until the housing market rebounds, Hoffman said Phoenix won’t see the job growth that it had enjoyed in years past. That rebound, he said, could be three to five years away.

Even though growth may be lagging, some Phoenix residents say they sense a noticeable improvement over the past six months. People and businesses are growing a bit more confident when it comes to spending, even if it’s happening slowly, they said.

“It’s getting better. I can tell by the amount of work I’ve been doing,” said Lou Gandron, a heating, ventilation and air-conditioning technician for Southwest Trane. “I think we are walking out of it. We fell into it, and we are going to have to walk out.”

“It is coming along very slow,” said Kay Gordon, a Phoenix businesswoman. She said her employer had three weeklong furloughs over the past two years and had laid off 30 people, 15 in March.

Others have doubts.

“The recovery people talk about is in their dreams,” said Jeffery Robinson of Phoenix. “People aren’t out there buying. More and more businesses are folding.”

Other states and regions, such as Colorado and Texas and much of the Midwest, have rebounded more quickly than metro Phoenix for a variety of reasons. Colorado was able to survive on a high percentage of employment coming from the government, positions that typically do not vanish during a recession. Texas’ economy is much more diversified, with well-developed clean-energy and information-technology industries. The Midwest, with its farming and manufacturing focus, also has a heavy presence in the export market, another area of stabilization during the recession.

Muro also suggested that Arizona’s relatively lower level of education is slowing its recovery. Colorado, with a better-educated workforce, was able to rebound more quickly as its laid-off employees were more successful at adapting.

How can Arizona reverse the trend?

The housing market continues to be relatively depressed, and the number of foreclosure properties in the Valley increased more than six times the national average during the first quarter.

Muro said that the way out is “clearly not back in to the real-estate-driven, speculative model.”

He believes the Phoenix area needs to move forward to a different kind of economy. The more diversity it has, the more durability an economy will have in an economic downturn, he said.

“It (Phoenix) needs to . . . invest in education, innovation and really work to build export markets,” Muro said. “The developing countries of Asia are growing. Where domestic consumption is muted, you need to go where the growth is going to come from.”

Hoffman said economic-development officials also are attempting to attract and grow new companies. But, he said, so is every other metro area. The competition is tough, and it is made tougher by the lack of confidence outsiders have in the Phoenix economy. “We can engage in it, but it’s just hard to predict that you are going to have massive job creation from new technologies and getting businesses here in the short term,” Hoffman said.

He advocates taking a strategic, long-term approach, investing in what will be needed five to 20 years from now.

For example, he suggests leveraging the money the state has received from the federal government and building new infrastructure, including roads, water-delivery systems and renewable energy. That could put people to work today and reduce unemployment, while “putting an infrastructure in place that would be growth-enhancing in the future,” he said.

Of course, the regional economy also relies on the national and global economy headed in the right direction.

Muro, citing the slow-to-grow employment figures and economic problems in Europe, fears the possibility of a double-dip recession.

Hoffman was slightly more optimistic. “There is a little sign of life. We have to put together a few more months of pretty good numbers and then we might be able to turn the corner.”

by Alan Zibel Associated Press Jun. 17, 2010 12:00 AM

WASHINGTON - Homebuilders are sending a message: They won’t be able to contribute much to the economic recovery now that government homebuying incentives have vanished.

Home construction and applications for building permits sank in May, overshadowing favorable reports on manufacturing and wholesale inflation.

Fewer homes means fewer jobs. Construction fuels a broad swath of industries across the economy. Yet double-digit unemployment is among the main reasons people have passed on buying new homes. Even with nearly record-low mortgage rates, the industry is struggling.

“The economy is growing, and the housing market is still in recession,” said Eugenio Aleman, senior economist with Wells Fargo Securities. “It’s not going to contribute to growth, but it is not going to pull the economy back down.”

Overall, new home and apartment construction fell 10 percent in May to a seasonally adjusted annual rate of 593,000, the Commerce Department said Wednesday. April’s figure was revised downward to 659,000.

Applications for new building permits, a sign of future activity, sank 5.9 percent, to an annual rate of 574,000. That was the lowest level in a year.

Builders are scaling back now that tax credits of up to $8,000 have expired. The biggest evidence of that trend: The number of new single-family homes tumbled 17 percent, the largest monthly drop since January 1991.

Steve Romeyn, managing partner of Windsong Properties in the Atlanta area, said the tax credits helped buyers sell their homes and move to his company’s retirement communities.

Now that the tax credits are gone, “I think we’re going to slip back and not be able to maintain the pace of the first half of the year,” he said.

But some builders see opportunity in the down market. Andrew Zuckerman, CEO of Zuckerman Homes in Coconut Creek, Fla., said his company is purchasing land and plans to develop it as early as winter.

“We think now is a good time to buy,” Zuckerman said. “We think the market is slowly stabilizing.”

The poor report on housing came despite more promising reports on the economy. Inflation at the wholesale level remains tame, and industrial production rose for the third straight month.

Output at the nation’s factories, mines and utilities climbed 1.2 percent in May, the Federal Reserve said Wednesday. Factory production rose 0.9 percent. Utility production jumped 4.8 percent because of warm weather that prompted people to crank up their air-conditioners. Mining was the only component that lagged.

Wholesale prices actually fell for a second straight month in May. But the 0.3 percent dip was pulled down by a 7 percent drop in gasoline prices and a 7.4 percent fall in home heating-oil prices. Core inflation, which excludes energy and food, rose 0.2 percent in May. It is up just 1.3 percent over the past 12 months.

Falling energy costs are expected to keep inflation low in June. Gasoline costs are down significantly from a month ago. The nationwide average for regular gasoline is $2.70 currently, down from $2.87 a month ago, according to AAA’s “Daily Fuel Gauge Report.”

Food costs dropped 0.6 percent, the biggest decline since July. The decreases were led by an 18 percent drop in the cost of fresh vegetables. But vegetable prices had been driven higher because of freezes earlier in the year in Florida.

The continued absence of inflationary pressures means that the Federal Reserve, which meets next week, can keep interest rates low to provide support for the economic recovery.

Wall Street appeared to show little concern with the housing figures. The Dow Jones industrial average edged up nearly 19 points in afternoon trading.

The rate of homebuilding is still up about 41 percent from the bottom in April 2009. But it’s down 70 percent from the decade’s peak in January 2006.

by J. Craig Anderson The Arizona Republic Jun. 17, 2010 12:00 AM

Commercial-property owners are counting on apartment buildings to lead the Phoenix area’s real-estate market toward recovery, based on a recent rebound for units rented and buildings sold.

That means renters are less likely to see future discounts and giveaways as aggressive as those they have received in recent years, although the mild recovery has not translated into higher rent prices thus far.

An immediate recovery for rental housing is by no means assured, but after two years of dismal sales and high vacancy rates, the double shot of good news has left some local real-estate professionals with a sense of hope.

“We are seeing a tremendous amount of buyer interest for multifamily assets in the Phoenix area,” said Bret Zinn, vice president of multifamily investment services for commercial real-estate firm Transwestern in Phoenix. “There is a scarcity premium being paid today, as the availability of saleable assets does not meet the demand of the deepening pool of investors.”

Zinn, a 15-year veteran of the apartment-sales business whom Transwestern hired in late January in anticipation of a market upturn, said significant losses in the value of apartment communities over the past two years are responsible for the shortage of buildings for sale.

As with all commercial real estate, many apartment owners are “upside down” on their commercial real-estate loans, meaning that they owe more on the loan than the property is currently worth, he said.

Zinn said most commercial real-estate lenders have been reluctant to accept the financial losses they would incur from approving short sales on the properties.

“Owners of apartments that would like to sell and take advantage of the many well-capitalized buyers in the marketplace are not able to do so without getting their lenders to agree to take a loss,” Zinn said.

Still, the return of buyer demand is a positive development that has yet to happen with most office, retail and industrial properties.

In the fourth quarter of 2008, only three apartment buildings changed hands. A year later, that number had increased to 13 sales, and it has gone up every quarter since then.

In the first quarter of this year, 18 apartment buildings were sold, compared with 13 in the first quarter of 2009. In the second quarter this year, 19 more were sold.

Nationally, the rental-housing market took a positive turn in the fourth quarter of 2009 and posted even bigger gains in the first quarter of this year, with the value of apartment properties increasing by 3.3 percent.

The same cannot be said for apartments in the Phoenix area, where the average sale price per square foot decreased by 20 percent from the first quarter to the second quarter, going from $43.91 to $34.83.

But other indicators have turned positive this year, including a huge jump in net move-ins, from 531 units in the fourth quarter to 4,179 in the first quarter. Total move-ins during the first quarter of 2009 was 1,121 units.

Apartment-building and other commercial real-estate owners across the U.S. have struggled to survive since the overbuilt real-estate market began to collapse in late 2007.

Job losses, a mass exodus of Hispanic residents and ever-growing competition from investors in foreclosed single-family homes have contributed to a precipitous drop in apartments’ value and an explosion in vacancies, experts said.

Apartment buildings usually lead the commercial real-estate market during both upswings and downturns, because the tenants’ leases, from six to 12 months, are shorter than with other commercial-property types.

A number of real-estate-related businesses that haven’t traditionally gotten involved in the rental market are doing so now, hoping to ride what passes for a positive wave.

One of those businesses is Internet home-listings site Trulia.com, which in November added rental-property listings to its online portfolio.

Trulia.com spokesman Kent Schumann said Web traffic to apartment-finding sites such as Rent.com and Apartments.com doubled during the past year.

“Seven of the top 20 real-estate (web)sites now are for rentals, whereas a year ago there were only three,” Schumann said.

Those numbers don’t necessarily add up to higher revenue for apartment owners, said Jon Pastor, founder and CEO of RentJungle.com, a Google-inspired apartment-finding service that Pastor launched in September.

The recent surge in available single-family homes for rent has kept many apartment owners from seeing the increased demand for rentals translate into lower vacancies and higher rents, although the Valley did see a very slight rent increase of 0.5 percent in the first quarter, he said.

Pastor said his reason for entering the rental-property market as a technology entrepreneur was a belief that the industry’s listing and search technology was in dire need of an overhaul.

He said the two biggest factors affecting apartment vacancies are population change and consumer confidence.

Because Arizona’s growth has slowed significantly, a significant drop in vacancy would require a boost in confidence, such as recent college grads moving out of their parents’ homes and roommates deciding they can afford their own places.

One group that generally has not helped fill apartment communities is the recently foreclosed upon, Pastor added.

Most former homeowners are opting to rent single-family homes and not apartments, he said.

Still, a number of real-estate experts said they have noticed a positive change in most consumers’ attitudes toward renting in general.

“I would think that adage that it’s always good to buy a house has kind of gone out the window,” Pastor said.

by Dawn Gilbertson The Arizona Republic Jun. 17, 2010 12:00 AM

An index of Phoenix-area home prices rose for the second consecutive month in May, the latest sign that home prices are stabilizing.

The Arizona State University-Repeat Sales Index rose 2.7 percent from a year earlier. That reverses a decline of the same magnitude in March. The index posted its first gain in about three years in April, rising 1 percent. Both April and May figures are preliminary and subject to revision.

ASU real-estate professor Karl Guntermann expects the year-over-year price gains to continue through the summer but not much beyond that because the economy is still weak.

“Unless there’s a dramatic change in the market in terms of the local economy improving or foreclosures suddenly slowing down dramatically - neither of which seem likely - it’s most likely that house prices will more or less flatten out for the rest of the year,” he said.

On the foreclosure front, the average price on foreclosure homes went up 3 percent in May from a year earlier, not as strong as the 5.3 percent increase in April. March was the first month foreclosure prices increased year over year since the downturn began.

“It’s probably saying the same thing: Prices are going to go up, but then they’ll just fluctuate,” Guntermann said.

Sales of foreclosure homes are dominating the market and price trends. Prices of non-foreclosure homes, as measured by the index, are still posting double-digit declines.

by Alan Zibel Associated Press Jun. 16, 2010 12:00 AM

WASHINGTON - Homebuilders are feeling less confident in the recovery now that government incentives for buyers have expired.

Their pessimism could drag on the economy, which may not benefit so much from the job creation that construction generates throughout various sectors.

The National Association of Home Builders said Tuesday that its housing-market index fell to 17 in June, sinking five points after two straight months of increases. It was the lowest level since March.

Builders had been more optimistic earlier in the year, when buyers could take advantage of tax credits of up to $8,000. Those incentives expired on April 30, although buyers with signed contracts have until June 30 to complete their purchases.

Experts predict home sales will slow in the second half of 2010. In addition, high unemployment and tight mortgage lending continue to keep many buyers on the sidelines.

The drop in activity is “a wake-up call to the fact that the market will struggle to stand on its own two feet without the tax credit,” wrote Paul Dales, an economist with Capital Economics. “The double-dip in both activity and prices that we have been expecting for some time appears to have begun.”

New-homes sales made up about 7 percent of the housing market last year. That’s down from about 15 percent before the bust.

It’s also bad news for the economy. Each new home built creates the equivalent of three jobs for a year and generates about $90,000 in taxes paid to local and federal authorities, according to the National Association of Home Builders. The impact is felt across multiple industries, from makers of faucets and dishwashers to lumber yards.

But it has weakened in recent years. Spending on residential construction and remodeling made up only about 2.4 percent of the nation’s economic activity in the first quarter of the year. That’s down from a peak of more than 6 percent during the housing market’s boom years.

In a typical economic recovery, the construction sector provides much of the fuel. But developers are trying to sell a tremendous glut of homes built during the boom years and they are competing against foreclosed homes selling at deep discounts.

Another problem for the building industry is that lenders are reluctant to make construction loans to developers.

by Catherine Reagor Arizona Republic June 16, 2010

Two years ago, Arizona’s largest private real-estate lender, Mortgages Ltd., was forced into bankruptcy. Its high-profile and expensive projects stalled shortly after that, as did the lender’s dividends to investors.

ML Holdings, successor to Mortgages Ltd., is now taking offers on one of the biggest developments in its portfolio, the Centerpoint Condominiums in downtown Tempe.

Proceeds from the sale will go to pay back the development’s many investors.

At least 75 large real-estate firms have expressed serious interest in the two towers, said Mark Winkleman, chief operating officer for ML Holdings.

Those companies have signed confidentiality agreements and provided ML with information on how they would finance the deal. More than 300 firms initially asked for information on the condo high-rises.

Tyler Anderson and Sean Cunningham of CB Richard Ellis are marketing the condo project, which ML Holdings foreclosed on a few months ago.

The 22-story tower is nearly complete, while much more work is needed on the project’s 30-story tower. The towers are being sold “as is.”

Other Mortgages Ltd. real estate that ML Holdings is now trying to sell:

• About 1,680 acres in Pinal County.

• Two central Phoenix townhouse sites with some partially built houses at 121 W. Maryland Ave. and 802 E. Missouri Ave.

• Also in Phoenix, partially built commercial buildings and some vacant land along Van Buren and 48th streets, a 42-unit apartment complex at 4540 E. Belleview St., and 5 acres of vacant land at McKinley and 44th streets.

• About 510 acres of vacant land in Eloy.

In March, ML Holdings sold the 21 brick mansions in central Phoenix called Chateaux on Central for $7 million.

The homes, nearly complete, with elevators and wine cellars, were marketed in 2007 for more than $2 million a piece.

Mesa land

Mesa is trying to sell 11,000 acres it owns in Pinal County to fund a new training field for the Chicago Cubs.

The city has hired Scottsdale-based land brokerage Nathan & Associates to sell the site, southeast of Coolidge along Arizona 87.

Mesa bought the Pinal land for $30 million in 1985.

by Luci Scott The Arizona Republic Jun. 12, 2010 12:00 AM

Elevation Chandler, the partly built hotel with a mortgage of $24 million, could realistically be sold for $5 million to $6 million, a top commercial broker says.

Moreover, a buyer would need to tear it down because a market no longer exists for another big hotel, and the steel shell has probably deteriorated so much that it’s no longer sturdy and safe.

Brent Moser, executive vice president of Cassidy Turley BRE Commercial, said the 10.6-acre property at Price and Frye roads is worth whatever the land is worth, and that depends on its intended use.

When construction began in 2005, a hotel may have been a good use, he said. “But quite a bit of hotel product has been built in the last years in that submarket, and it will be a couple of years before that use makes sense again,” Moser said.

Another possible use would be Class A office space, which Chandler officials had pondered. But office space is overbuilt.

The best use of the property would be made by a retail tenant that wants to be close to Chandler Fashion Center, Moser said.

The market now for a retail user could be $10 a square foot, making the site worth $5 million to $6 million, he said.

Moser has talked with contractors, and the consensus is the buyer would need to demolish the abandoned existing structure. Steel, concrete and plumbing can’t be exposed long to the weather.

“There are questions out there as to whether that structure can be utilized,” he said. “My guess is they’d have to start over.”

He put demolition costs at $400,000.

Moser suggested a logical retail tenant would be high profile, such as an Ikea or other furniture store; higher-fashion users such as boutiques; or a big-box store.

A big box of 150,000 square feet would need a larger parcel, because the conventional formula is having a building cover about 25 percent of land. So the buyer would need to pick up some land to the south, although that would take work to get the extra land rezoned from office to retail.

“I’ve got to think Chandler is going to be pretty cooperative, given the fact that eyesore has been there going on three or four years now,” Moser said.

“That’s not to say the retail world is going gangbusters right now, but there are tenants still lurking around the city looking for new locations,” Moser said.

Plus the Chandler Fashion Center is so successful, it would be a big draw to a new neighbor.

Whatever goes on the spot, it won’t be soon.

“It’s such a legal nightmare that I would speculate it’s at least another 18 to 24 months before all of the lawsuits . . . and whatever mess that’s out there gets flushed out of the system so the property can be sold and developed.”

The rehabilitation process would be expedited if Chandler dedicated some redevelopment funds, he said.

“It could be argued that this is a blighted property, although it sits in proximity to one of the most successful retail projects we’ve seen in 20 years in Phoenix,” Moser said.

“It may take some cooperation like that to pry it away if it winds up in Point Center’s (Point Center Financial, the mortgage holder) hands.”

It would take another six or seven years to justify luxury condominiums and a hotel of the magnitude that developer Jeff Cline had in mind, Moser said.

The dream for that site wasn’t bad, Moser said.

“It was a great location and a great project that may have overshot the condo portion a little.”

Bruce D’Agostino, executive director of the Washington, D.C.-based Construction Management Association of America, doubts a buyer would build on the skeleton.

“That structure would have to come down,” he said. “Nobody is going to assume the liability on that.”

by Luci Scott The Arizona Republic Jun. 12, 2010 12:00 AM

The Phoenix architectural company Aecom, formerly DMJM H+N, is owed $851,472 by developer Jeff Cline for architectural work on Elevation Chandler.

That is the largest unsecured claim in the list of creditors Cline filed with U.S. Bankruptcy Court when he sought Chapter 11 protection in April 2008.

Judge Sarah Curley dismissed the case last week.

The case’s dismissal allows creditors to sue Cline.

When he filed, Cline said the creditor with the second-largest claim was another architectural firm, Gould Evans of Phoenix. He said he owed it $606,717, but Gould Evans claimed $704,270.

Other claims listed by Cline when he filed for bankruptcy protection included Spark Design of Tempe, an ad agency that created the name Elevation Chandler and its website, $125,000. Spark Design countered that it was owed a higher amount: $310,713. In total, Cline claimed $59.9 million in liabilities to creditors holding secured claims, including investors, and $1.7 million to creditors with unsecured, non-priority claims.

by Catherine Reagor The Arizona Republic Jun. 13, 2010 12:00 AM

Mark Henle/The Arizona Republic Luis Bojorquez frames a Meritage Home under construction in the Gilbert community Lyon’s Gate.

So far this year, according to the Arizona brokerage firm Land Advisors, homebuilders here have spent $90 million on land purchases for new homes. That’s the most builders have invested in the region’s land in any year since the peak of the housing boom in 2006.

New land purchases are a sign the cycle is stirring to life again in a retooled housing industry.

The parcels of land and the pool of builders buying them are both much smaller than before the real- estate crash. But residential lot prices are climbing as a steady stream of purchases by builders the past six months restarts the region’s new-home industry.

Home building had a predictable pattern in the Phoenix area prior to the 2007 housing-market crash. Builders bought lots in the newest edge communities, built and sold homes and then bought more lots. Big builders bought land years ahead of construction.

The crash disrupted that pattern and left builders with unsold homes and vacant lots. Houses and lots were sold off at sale prices. Some builders lost large parcels of land to foreclosure. Other builders slid into bankruptcy or simply closed. Home building slowed to levels not seen since the 1970s.

Builders who survived the crash have cut operating and building costs and are trying to eke out smaller profits on fewer home sales. Many of the big builders have cash to spend on land again but are buying only what they can sell homes on quickly.

Federal aid from a new tax break and a shift by homebuyers away from foreclosures are also driving the recent land purchases.

“Builders are buying Phoenix-area land now because they expect to make money on it in the near future,” said Arizona home-building analyst RL Brown. “Builders are more optimistic about the housing market now, but the smart ones are still being very cautious.”

Land

The $90 million in recent land purchases by builders reveals new trends and different hot spots for the new-home market stirring back to life in Phoenix.

Homebuilders are more selective now, buying fewer lots and in specific target areas. Sites closer to Phoenix’s core and near freeways are drawing the highest prices. Builders want lots prepped and ready for new homes for faster, less-expensive turnaround in the buy-build-sell cycle.

“Most builders now will buy 50 to 100 lots in a development, instead of the 200 lots they would have purchased before the boom,” said Nate Nathan, president of Scottsdale-based land brokerage firm Nathan & Associates. “Builders have adapted to the new market reality in Phoenix. The profit margins are tight.”

Mesa, Chandler and Gilbert, land brokers say, are now the hot spots for homebuilders. Lot prices in those southeast Valley communities have almost tripled in the past two years. Home sites are selling for more than $80,000 in parts of Chandler, prices similar to what builders paid in the pre-boom years of 2003-04.

More than 50 percent of metro Phoenix’s new-home sales during April were in Mesa, Chandler and Gilbert.

Developments along the Interstate 17 corridor north to Anthem and in Avondale and Goodyear in the West Valley are also popular with builders. Land prices in these areas are climbing as well, but lots are still typically selling for below $40,000.

Parcels in metro Phoenix’s most far-flung communities including Buckeye west of the White Tank Mountains and the Pinal County communities of Coolidge and Eloy aren’t drawing a lot of builder attention now. The areas are too far out for most current buyers because their tastes have changed, no matter how inexpensive new homes are priced.

|

Builder profits

Despite recent increases in new-home construction and sales, the home-building industry is still dealing with the worst housing market in Phoenix history.

About a dozen of the region’s builders have figured out ways to make money constructing less-expensive homes. These builders have cut costs on labor, materials and marketing. Builders no longer own the expensive land purchased during the boom. That land was sold for a loss or lost to foreclosure. Now, builders are repurchasing the same land for less than half what it sold for in 2004-06.

“Smart builders have cuts costs to the point where they can sell homes for less but still see a slight profit,” Brown said. “Construction costs are half of what they were five years ago. Builders’ office and marketing overhead is one-third of what is was then. Homes have been streamlined with fewer expensive amenities and extras.”

Brown said to save money, the president of one of metro Phoenix’s biggest homebuilders serves as salesperson at one of his subdivisions every Friday.

Most builders also are receiving some federal help. A change in the federal

He said there are subdivisions in metro Phoenix where 20 to 30 new homes are selling a month. Last year, builders were reporting fewer than five home sales a month in most of the area’s subdivisions.

Homebuyers

A recent shift in metro Phoenix home-buying tactics also is helping homebuilders.

More homebuyers have become frustrated with the bidding wars and delays in foreclosures and short sales. During the past few months, a growing number of people have opted to buy new homes or existing homes sold through a regular sale.

“We are competing with the resale market in the Valley,” said Steve Hilton, chairman of Scottsdale-based Meritage Homes. “People will pay a small premium for a new home now in prime locations.”

The median price of a metro Phoenix new home sold during April was $199,362, up from $188,000 a year earlier, according to the “Phoenix Housing Market Letter.”

Many builders ramped up home construction in anticipation of the federal homebuyer tax credit. The deadline for the credit was April 30. Buyers have until June 30 to close on home purchases signed by the deadline. That means sales spurred by the federal tax credit could boost new-home sales until July.

Josh McNeil is shopping for a new home in Gilbert or Queen Creek. He didn’t make the deadline for the federal tax credit but thinks he will find better deals on homes now.

“Prices have gone down some in a few places where I am looking,” he said. “I think the builders built homes for buyers they thought would move faster for the tax credit.”

New-home sales in metro Phoenix climbed slightly to 823 in April from 789 during the same month a year ago.

McNeil is planning to buy in the next six months and wants a new home because he has friends who have failed multiple times trying to buy foreclosures or short sales.

Cautious outlook

The increase in land purchases is one of several early signs of higher expectations for the new-home market.

Nationally, builder confidence is the highest it’s been since August 2007, according to the monthly National Association of Home Builders/Wells Fargo Housing Market Index.

Through April, new-home permits in the Phoenix area were up 90 percent from last year.

But to keep that increase in perspective, 2009 was the slowest year for home building since the early 1970s. For the first four months of this year, 2,964 new-home permits have been issued in metro Phoenix, compared with 1,561 for the same period in 2009. May figures aren’t yet available.

“I think Phoenix’s housing market will gradually get better. But I am not looking for it to get dramatically better anytime soon,” Hilton said. “Some builders are overpaying for land now because they are too optimistic.”

Land prices have climbed faster in metro Phoenix than in almost any other part of the country, according to a report from the national housing-research firm Zelman & Associates. California’s Inland Empire area has also seen big jumps in land prices

The forecast for metro Phoenix home building during the next few years is for small annual increases until at least 2012.

Housing analyst Brown expects 8,500 new homes to be built in metro Phoenix this year, up from 8,000 in 2009. But his forecast calls for 22,000 new permits in 2012.

Market watchers are waiting to see if new-home sales continue to climb later this summer, after the final deadline for the federal homebuyer tax credit. No one is expecting big monthly increases in metro Phoenix home building this year, but small gains could lay a foundation for the industry’s recovery.

by John Yantis The Arizona Republic Jun. 10, 2010 12:00 AM

A new Arizona State University real-estate report shows home foreclosures may be leveling off, but the author says it’s unclear if the trend will continue because of the number of defaults and late payments still plaguing the market.

Foreclosures were 33 percent of the market’s recorded activity in May, down from 40 percent in March, according to the latest realty-studies report.

The question remains whether the drop is a simply a blip, said Jay Butler, an associate professor of real estate who authors the study.

“We’re sort of at a break point,” Butler said. “Are we now going to see foreclosures decline, or is it simply for other reasons this is just a respite and we’re going to see an increase? Because we’ve not been here before, it’s hard to say which fork in the road we’re going to take.”

A number of issues will continue to affect the real-estate market, he said. Defaults and late payments remain at record levels, and they could be a precursor to additional foreclosures. Income may not increase enough for people to hold on to their current homes, especially if they are confronted with a change in an adjustable-rate mortgage that could reset in coming months, Butler said.

And he worries that this time of year may cause many people with high debt to walk away from homes with declining neighborhood values.

“A lot of people are looking at the end of school for their kids as a key point,” Butler said. “If they had gotten foreclosed on a few months ago, they would have had to leave and take the kids to another school. Now, they can easily move the kids, maybe without losing face or explaining everything, and move to another area.”

Arizona’s pending immigration law may also hurt the market, Butler said.

Still, there are some bright spots.

The number of new foreclosure filings against Phoenix-area homeowners fell in May to the lowest level since July 2008, according to the Information Market. Foreclosures also dropped last month to 4,090, their lowest since November 2009, the report said.

Butler’s research shows that, as a total, foreclosures added together with the sales of previously foreclosed-on properties still represented 60 percent of the recorded activity in the Valley housing market in May.

For the past year, about 42 percent of the traditional sales were foreclosure homes sold again with a median markdown of 15 percent from the foreclosure price, he said.

More than 3,200 single-family homes in the Valley were foreclosed on during May of this year. That’s down from almost 3,500 foreclosures in April but up from slightly more than 3,000 in May of last year.

The market is less busy but higher-priced this spring than last spring, the report shows. The number of homes resold was more than 6,400 in May. That’s down from almost 6,800 in April and almost 7,000 the previous May. The median single-family home price for resold homes $144,000 in both April and May, significantly up from $130,000 May 2009.

by Catherine Reagor The Arizona Republic Jun. 9, 2010 12:00 AM

The number of new foreclosure filings against Phoenix-area homeowners fell in May to the lowest level since July 2008.

Last month, there were 6,471 pre-foreclosures, or notice of trustee sales, filed in metro Phoenix, according to the Information Market.

Foreclosures also dropped last month to 4,090, their lowest since November 2009.

R.O.I. Properties, led by Beth Jo Zeitzer, attributes the drop in foreclosures to federal loan-modification programs, successful short sales and more investor purchases at trustee-sale auctions.

The U.S. Treasury Department, which manages the federal housing plan to slow foreclosures, reported increases in both trial and permanent loan modifications in the Valley during April.

Foreclosure help: Neighborhoods Housing Services of Phoenix hosted a rally in downtown Phoenix on Tuesday to launch a new public-awareness campaign, “Take a Stand Against Foreclosure Scams.”

Free help for homeowners facing foreclosure is available from Arizona housing non-profits. But the number of homeowners scammed by firms charging for mortgage help is still on the rise.

Karen Scates, mortgage-relief coordinator for the Arizona attorney general, said complaints about loan-fraud and modification scams have quadrupled in the past year.

Loan-mod alert: A lawsuit has been filed against Scottsdale-based Discount Mortgage Relief and Mortgage Relief LLC by the Arizona attorney general.

The suit alleges the firms engaged in deceptive loan-modification services and charged consumers $1,500 to $5,000.

An Arizona law that prohibits loan-modification firms from collecting upfront fees goes into effect on July 29.

“Instead of providing assistance, many loan-modification companies have been pocketing large upfront fees and failing to obtain any kind of mortgage relief for homeowners,” Arizona Attorney General Terry Goddard said.

by Russ Wiles The Arizona Republic Jun. 9, 2010 12:00 AM

Metro Phoenix’s bankruptcy trend improved for a second straight month in May, but it’s too early to conclude the picture has brightened.

The 2,763 filings in the metro area still were up 35 percent from May 2009.

“We hear politicians saying the recession is over, that all is well, but we’re not seeing it,” said Mark Winsor, a bankruptcy attorney at Winsor Law Group in Mesa.

Soft housing prices, a bleak employment scenario and other financial issues continue to plague many residents.

Chapter 7 filings, which provide a fresh financial start for debtors, accounted for 83 percent of the Valley total - the third straight month they’ve been over 80 percent. With ongoing employment problems, more people apparently are able to meet the Chapter 7 income-eligibility limits, attorneys say.

Chapter 13 debt restructurings, geared to people with regular job income who can’t qualify for Chapter 7, accounted for most of the rest.

Winsor said he’s noticed more owners of upscale homes seeking bankruptcy protection, yet many of these people have too much debt to qualify for either a Chapter 7 or Chapter 13 filing.

To qualify for Chapter 13, for example, a person can’t have more than $1,081,500 of secured debt or $360,525 in unsecured debt, he said. These people would have to go the Chapter 11 route, he said.

Bankruptcy attorneys elsewhere around the state also are singing much the same tune.

“I don’t see a slowdown (in the number of filings) for a while,” said attorney Daniel Rylander at law firm Robinson & Rylander in Tucson. “We’re about as busy as we’ve been.”

Tucson-area filings haven’t shown quite the same large year-over-year percentage increases as in the Phoenix area. They’re up just under 30 percent so far in 2010, compared with 47 percent here.

Rylander said that’s mainly because Tucson-area home prices didn’t rise so much during the bubble a few years ago.

“We had less far to fall,” he said.

In contrast to the situation in Arizona, the bankruptcy picture for the nation as a whole does appear to be improving.

The 136,142 U.S. consumer bankruptcies reported by the American Bankruptcy Institute and National Bankruptcy Research Center were down 6 percent from April and up just 9 percent from May 2009.