After considerable pain, downsizing and nearly $1 billion in cumulative losses, Arizona’s native banks finally might be turning the corner.

The 37 banks still based in the state just wrapped up their best quarter since the financial crisis and recession began, breaking a string of 12 straight quarters during which the majority of institutions here lost money.

On balance, the local industry is profitable again, albeit by a razor-thin margin that partly reflects the demise of some of the weakest players. Still, bankers are sensing a silver lining in the latest numbers, and they’re not complaining.

“It’s a good story, a change in the weather,” said Stephen Haggard, president and chief executive officer of Metro Phoenix Bank. “The local economy is doing better, with definite improvement from six months or a year ago.”

As local banks recover, that could make more lending dollars available to customers here, especially small businesses, while improving overall banking services and perhaps even reversing the three-year decline in employment at these firms. Healthy local banks also are in a better position to donate to non-profits and support the community in other ways.

Metro Phoenix Bank posted a $624,000 first-quarter profit after basically breaking even one year earlier.

The big news is that bad-loan difficulties are easing, at long last.

“Problem assets have been dramatically reduced,” said Scott Schaefer, president of Meridian Bank, which improved to a $2.9 million first-quarter profit from a loss of $11.1 million a year earlier.

“We took our lumps in 2009 and 2010,” he said, citing write-downs and other responses for dealing with problem loans.

The banks headquartered in Arizona earned nearly $20 million combined from January through March, with 19 of the 37 turning a profit, based on a preliminary tally of financial reports supplied to the Federal Deposit Insurance Corp.

The agency will release final statewide numbers later this month.

Many local banks were and remain highly exposed to real-estate lending, since that industry was the state’s main growth catalyst for so many years.

The Arizona totals exclude figures for banks that operate here but are based elsewhere, such as the three largest companies with an Arizona presence - Wells Fargo, Chase and Bank of America.

They also don’t include banks that have failed, merged or been acquired over the past few years.

The majority of local banks have been running in the red for the past three years, hammered by real-estate setbacks and hemorrhaging the capital that regulators require for them to stay in business.

At the nadir in late 2009, 84 percent of Arizona’s banks were unprofitable.

Combined, Arizona’s local banks lost $950 million across 2008, 2009 and 2010.

Since the end of 2007, the state has lost 20 banks through failure, merger or acquisition and shed more than 1,500 related jobs.

Also, market share has become more concentrated in the hands of the big out-of-state entities that, critics say, are less motivated to lend locally.

“Local banks will reinvest the money in small businesses,” said Ernest Garfield, president of Independent Bank Developers of Scottsdale and a former Arizona state treasurer and Corporation Commission member.

“The big banks will drain it out of the state.”

Bankers at large institutions contest that claim, but it’s clear that having more healthy entities increases the availability of local loan dollars.

The improved recent numbers for local banks don’t mean all is well. Some of the weakest banks in Arizona and nationally continue to struggle.

The FDIC’s list of “problem” banks is still rising, with one in nine institutions nationally and an untold number in Arizona under close scrutiny. The agency doesn’t name banks on its list out of concern for inciting runs by depositors.

The FDIC generally insures depositors up to $250,000 per bank.

Small community banks that represent the backbone of Arizona’s industry have been hit harder than larger national banks, which have more diversified operations.

The U.S. industry actually remained profitable throughout the slump and earned $87 billion in 2010 - almost back to pre-recession levels.

Arizona banks, as noted, have been heavily dependent on real estate.

Perhaps the main reason banks in Arizona and elsewhere are reporting better numbers is that loan problems and delinquencies are easing, so banks don’t have to increase their reserves to cover losses.

When banks must boost reserves, that eats into profits and capital.

Also, banks are earning higher spreads between what they generate on loans and pay on deposits, and they’re earning more in fee income, Haggard said.

Schaefer sees opportunities for well-positioned banks but cautions that metro Phoenix’s economic recovery remains “spotty.”

Haggard is more optimistic. While real estate remains depressed, prices aren’t dropping as fast as before, he said.

Also, borrowers in other industries generally are faring better.

“The financial reports we’re receiving from clients are showing stronger cash flow and top-line revenue numbers,” he said.

Garfield feels now is a great time to start a bank in Arizona, reflecting the decreased competition, gradual improvement in the economy and other factors.

“Also, bankers have finally learned what gets them in trouble,” he said.

Add it all up and there are reasons for optimism.

Local banks focus their lending within Arizona and thus are a key cog in the economic-development machine.

If they have finally turned the corner, that could be a good indicator for everyone in the state.

by Russ Wiles The Arizona Republic May. 15, 2011 12:00 AM

Phoenix-area residents don’t need to hang out on the courthouse steps in downtown Phoenix to get a detailed view of what’s happening at Maricopa County’s daily trustee’s sale auctions, where homes either get bought by competing bidders or become bank-owned property.

California-based Foreclosure Radar has been gathering and reporting a variety of data on foreclosure auctions in major metro areas including Phoenix.

The company from Discovery Bay operates a Web portal partly reserved for paying clients, but the free and publicly accessible areas offer much information at foreclosureradar.com.

The site’s Maricopa County page tracks several aspects of area foreclosure sales, such as the percentage of properties that become bank-owned because no third parties bid on the property or because the minimum price was too high.

It provides a breakdown of lender repossessions, sales to third-party buyers, the average opening bids and winning bids, the average length of time it took to complete a foreclosure, and more.

For example, the average time it took to foreclose on a home in Maricopa County in March, the most recent month available, was 191 days - more than twice the minimum notice requirement of 90 days. That’s up 33 percent from the average of 144 days in March 2010, according to ForeclosureRadar. The website also analyzes monthly foreclosure totals based on factors including property size, amount of mortgage-principal owed and the year the mortgage loan was issued. Of the 5,606 homes foreclosed on in March, the largest number had loans issued in the second quarter of 2007 (828 homes), followed by homes with loans issued in the first quarter of 2006 (752 homes).

by J. Craig Anderson The Arizona Republic Apr. 17, 2011 12:00 AM

NEW YORK — The Obama administration outlined three options Friday to change the way home loans are financed, calling for the slow death of mortgage giants Fannie Mae and Freddie Mac and jumpstarting the debate over the future role of government in helping borrowers secure mortgages.

If implemented, the proposals would likely make it more expensive for borrowers to buy a home and thus restrict the availability of mortgages. It also marks a significant departure from past government policies, which treated homeownership in America as a virtual right.

“The government must…help ensure that all Americans have access to quality housing that they can afford,” the administration said in its report to Congress, delivered as part of last year’s financial overhaul law. “This does not mean our goal is for all Americans to be homeowners.”

The troubled housing market — a legacy of the deep bust that followed a historic boom in which reckless lending and borrowing led to the most punishing downturn since the Great Depression — led to calls for the federal government to radically reform the way home mortgages are financed. There’s $10 trillion in outstanding home loan debt.

Policy makers, bankers and investors agree that taxpayer-owned Fannie and Freddie should be wound down. But there’s no consensus on what should replace them.

The first option outlined in the report calls for a private system in which lenders and investors fund new mortgages, with a limited role for existing federal agencies to subsidize home loans for the poor and other special groups, like veterans. The second proposal calls for much of the same, but it includes a government backstop for mortgages during times of market stress. If credit markets froze — like they did at the height of the crisis — the government would step in and guarantee new home loans. The third option outlines a much broader government role. Under this alternative, taxpayers would insure securities backed by home loans, which is what Fannie and Freddie already do.

The administration’s outline explained the benefits and costs of the various options, but stopped short of endorsing any of them. Critics will likely say the administration punted.

The 31-page outline says “very little that is surprising or market-moving as it lacks specific details or…any extreme views,” mortgage bond strategists Greg Reiter and Jeana Curro at RBS Securities wrote in a note to clients. They were “mildly surprised” at the lack of details, though.

Analysts at Amherst Securities, led by Laurie Goodman, said in a report that the plan is “largely a non-event.”

Along with federal agencies, taxpayer-owned behemoths Fannie Mae and Freddie Mac guarantee more than nine of every 10 new mortgages. They were effectively nationalized in 2008. Delinquencies on home loans they back have thus far cost taxpayers more than $150 billion. Their regulator, the Federal Housing Finance Agency, estimates Fannie and Freddie could need up to $363 billion in taxpayer cash through 2013, it said in an October report.

“We are going to start the process of reform now,” Geithner said in a statement. “But we are going to do it responsibly and carefully so that we support the recovery and the process of repair of the housing market.”

Geithner said it will take another three years for the housing market to recover. It currently suffers from a high foreclosure and delinquency rate, low levels of homeowner equity, and an abundance of homes for sale without a corresponding number of interested buyers.

After that, it will likely take two to three years for policy makers to come to agreement on the government’s role in funding home loans, Geithner said. The final step calls for new legislation. All told, Geithner said it will take between five to seven years to transition to a new system.

Steps to take during that time to slowly wean the market off total government support largely revolve around making Fannie- and Freddie-backed mortgages more expensive, which would make loans not backed by taxpayers more desirable. This includes increasing the fees Fannie and Freddie charge to guarantee home loans backing securities; pushing them to require homeowners to purchase additional mortgage insurance or put at least 10 percent down; and reducing the size of individual loans that Fannie and Freddie could guarantee.

But while the administration wants to decrease government’s role in funding home loans, it wants to increase federal subsidies for rental housing. Shaun Donovan, the secretary of the Department of Housing and Urban Development, said Friday that half of renters spend more than one-third of their income on housing, and one-quarter of renters devoted more than half, according to HUD research.

Reactions from lawmakers ranged from pleasant surprise to muted displeasure.

Rep. Barney Frank of Massachusetts, the top Democrat on the House Financial Services Committee, praised in a statement the administration’s support for increasing resources directed towards renters, but said it is “not clear” whether lenders and investors alone could support the market in a way that makes mortgages affordable to borrowers.

Rep. Ed Royce, a Republican from California who also serves on the financial services committee, said he was “pleasantly surprised” that the administration wants to wind down Fannie Mae and Freddie Mac.

“The 800-pound gorilla in the room remains the level of government support in the mortgage market going forward,” Royce said in a statement. “On that front, [the Obama administration] decided to punt.”

Rep. Maxine Waters, a California Democrat and another financial services committee member, said she has “concern” that the administration’s proposals “may radically increase the cost of homeownership, and housing in general.”

The theme of the report and subsequent conversations with administration officials stressed the Obama team’s desire to have a smaller government footprint in the mortgage market.

“The report’s takeaway message is that the U.S. housing finance system is likely to undergo major changes going forward, and with the likely outcome being a significantly smaller role for the U.S. government,” analysts at research firm CreditSights said in a note.

The reality is Democrats want continued government support of mortgages backing securities.

A fully privatized system would lead to higher costs for mortgages, but it would also nearly extinguish the risk posed to taxpayers and would enable resources currently devoted to housing to go to more productive channels, benefitting the economy in the long run, the administration noted in a nod to the predominant Republican position.

A hybrid approach that calls for increased government support during times of market stress would enable the government to lessen the social costs from contractions in credit to borrowers. Maintaining government backing of home loans at all times ensures cheap mortgages, thus artificially inflating home prices and allowing resources to continue flowing to housing. This proposal also puts taxpayers on the hook for losses.

But while observers say the administration appears to favor a robust government role — analysts at RBS Securities say government-sponsored entities and federal agencies will likely end up supporting 50-65 percent of the market — it’s not clear that one is needed.

Firms would package home loans into bonds and Investors would buy them absent government guarantees, market participants said Friday. Mortgages would be more expensive, but only compared to today’s historically-low prices. Over time, they’d moderate to average levels, they said.

In effect, Democrats’ argument that the cost of mortgages would skyrocket lacks merit, they said.

“The notion that the cost of these products would be extraordinarily high is predicated on the notion that we continue to accept no down payments on loans,” said Joshua Rosner, managing director at independent research consultancy Graham Fisher & Co. and one of the first analysts to identify problems at Fannie Mae and Freddie Mac.

Brett D. Nicholas, the chief investment and operating officer at Redwood Trust, a California-based real estate investment firm, said that with taxpayers backing 95 percent of new home loans “there is no room for the private sector.”

“It’s a circular argument to say that, ‘Well, the private sector is not there so oh my God rates are going to go up hundreds of basis points,’” Nicholas said. “It’s just not true.” One basis point equals 0.01 percentage point.

“The fact is the private sector is there,” Nicholas added. “We have capital. Lots of firms like us have capital. There’s trillions of dollars of demand from life insurance companies, banks, [and] mutual funds.”

Last year, his firm sponsored the only private-sector security backed by new home mortgages and sold to investors. The deal contained more than $200 million worth of jumbo mortgages, industry parlance for home loans too big to be backed by the Federal Housing Administration, a government agency, or Fannie Mae and Freddie Mac.

“The dollars are there,” Nicholas said. “There’s just no loans to sell to [investors] because they’re all going to Fannie, Freddie and FHA.”

Rosner said that if borrowers start putting down 20 percent of the purchase price, investors would price in lower risks of default and snap up the securities.

He added that getting borrowers to put that much down is good for the economy because it gets consumers in the habit of saving more and only being willing to buy a home once they were sure they could afford it.

This would lessen the risk of a housing collapse and minimize costs to taxpayers, Rosner said, as opposed to the administration’s preferred approach of a continued government role, which he argues simply continues the current system of privatized gains and socialized losses.

“The administration is still not thinking of ways to incent proper behavior,” Rosner said. He added that the tax code could bring about many of his recommendations.

by Shahien Nasiripour Huffington Post February 11, 2011

Housing will gradually begin to recover in the second half of this year, David Goldberg, UBS’ home-building analyst, writes in a client note today. That assertion comes with 10 predictions for the year. (We’ll be happy to check back in 2011 and see how he did.)

- “Fundamentals will remain ‘choppy’ in the first half of the year, with conflicting data points making it difficult to ascertain whether we’ve actually reached the trough in housing.” We can’t argue with this one: Data points have turned into a roller coaster.

- “Headline risk, primarily driven by the government’s efforts to extract itself from the mortgage market, will drive the homebuilding stocks down 15% or more from current levels.” Mr. Goldberg continues: “With the longer term path for fundamentals offering limited clarity, we expect the homebuilding stocks to remain quite volatile and extremely sensitive to news flow.” We don’t need to remind investors how far they’ve already fallen from peak levels — or how they bounce around day-to-day!

- “The previous prediction notwithstanding, the government is going to do everything in its power to protect home prices.” Mr. Goldberg says: “In the end, we believe that concerns about higher rates and declining mortgage market liquidity won’t amount to much. In our opinion, the government has continually made it clear that it is working to limit further home price declines given the serious ramifications these declines would have for both consumers and lenders.” Read: Housing is too big to fail.

- “Although we forecast that as many as 7 million foreclosures are likely to occur over the next several years, we believe the pace at which these homes will come to the market will be consistent with current levels. As such, the concerns around the negative impacts of rising inventory levels are overdone.”

- “An improvement in unemployment is the single most important predictor for the longer term health of the housing market—only by focusing on this variable can we truly understand the timing for a recovery.” Yes, but when will jobs improve? Mr. Goldberg writes that UBS expects payrolls will start to recover in the first quarter, followed by a sharp rise in 2Q. Much of this will be driven by the hiring of temp workers, labeled a key forward indicator.

- “An improving jobs picture will drive greater price stability and better demand. That said, given the level of excess inventory, the pace of price appreciation will be below trend for some time.” So buy to live, not to flip for a quick buck.

- “The builders will see sequential improvements in their quarterly results.” They almost have to, given how the sector’s crash left them battered.

- “Given the limited amount of high quality, finished lots coming to market, we expect the builders to increasingly consider purchasing undeveloped parcels, which represent a greater value. This trend will be magnified if conditions start to accelerate more meaningfully in the near term as builders look to rebuild their operations over time.”

- “Although residential construction lending standards might loosen in 2010, liquidity will be insufficient to drive starts towards current consensus estimates.” Mr. Goldberg writes that lenders are reluctant to commit new capital to residential construction. Consensus for 800,000 single- and multi-family starts is “too aggressive,” he writes, putting the figure at between 700,000 and 720,000.

- “The longer term outlook for housing will increasingly dominate investors focus toward the end of 2010.” Does this mean even more obsessing over daily, weekly and monthly data? Perish the thought!

Readers, what do you think? Do you agree with Mr. Goldberg?

By Dawn Wotapka The Wall Street Journal January 14, 2011

Your worldwide news source for mortgage, real estate, and financial news.

In an acknowledgment that the foreclosure crisis is far from over, the Obama administration on Wednesday pumped $3 billion into programs intended to stop the unemployed from losing their homes.

The housing market, which usually helps lead the country out of a recession, is this time helping hold the recovery back. Interest rates are at record lows, but too few can afford to buy or refinance. Unemployed homeowners who live in communities where values have fallen sharply are often unable to sell. Their foreclosures weaken neighborhoods and create a vicious circle by further undermining the market.

To try to break this pattern, the Treasury Department said it was adding $2 billion to its Hardest Hit Fund, roughly doubling its size. The fund, first announced by President Obama in February and expanded in March, goes to housing finance agencies in various states to create local aid programs.

Most of the state programs from the first two rounds are barely under way, but Treasury officials said it was clear that more funds were needed. “In this very deep recession, people have tended to be out of work a little longer,” Herbert M. Allison Jr., assistant secretary for financial stability, said. “That’s why we think this additional relief for people searching for a job is so important.” The second program, announced by the Department of Housing and Urban Development, will draw on $1 billion authorized by the new financial overhaul law.

The agency said it would work with local aid groups to offer bridge loans of up to $50,000 to eligible borrowers to help them pay their mortgage principal, interest, insurance and taxes for up to 24 months. The loans will be interest-free. Until now, the Hardest Hit Fund had been projected to help about 140,000 borrowers. Treasury officials said that number would grow with the new infusion of money, but offered no estimate. HUD also did not say how many homeowners would be eligible for its program.

If the new money is spent in the same way as the previous money, both programs would eventually aid about 400,000 borrowers — a large number, but not when set against the 14.6 million unemployed or three million contemplating foreclosure. Over the last two years, the government has deployed many programs to help housing. It pushed interest rates down, offered tax credits and set up an ambitious mortgage modification program. Yet housing remains feeble and seems poised after a brief respite this year to become weaker again. “I think all these government programs are helpful, but I wouldn’t look for them to cure the recession or even what ails housing,” said the economist Karl E. Case. “At best, they’re preventing things from getting much worse.”

The Hardest Hit Fund will draw on the $45.6 billion set aside for housing in the Troubled Asset Relief Program, the rescue measure begun at the height of the financial crisis in the fall of 2008. Initially, the fund gave $1.5 billion to five hard-hit states: Arizona, California, Florida, Michigan and Nevada. The second round in March of $600 million went to North Carolina, Ohio, Oregon, Rhode Island and South Carolina.

The expanded list of states eligible for the latest funding includes Alabama, Illinois, Kentucky, Mississippi and New Jersey, as well as the District of Columbia. Each state’s share of the money is based on its population. Many of the programs involve direct assistance. Ohio, for instance, said it would use its $172 million to aid 15,356 homeowners by helping bring delinquent mortgages current for owners experiencing hardship because of a loss of income. The assistance will last up to 12 months.

The other housing money in the Troubled Asset Relief Program is earmarked for the modification programs ($30.6 billion) and a Federal Housing Administration refinancing program ($11 billion). The administration can shift money between the programs only until Oct. 3, the two-year anniversary of the program. HUD said it was in the process of determining which communities would receive its money and how exactly the process would work.

“We’re still in the design phase,” said Bill Apgar, HUD senior adviser for mortgage finance.

by David Streitfeld New York Times august 11, 2010

by Adam Quinones on June 23, 2010

Fannie Mae announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure.

Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure.

“We’re taking these steps to highlight the importance of working with your servicer,” said Terence Edwards, executive vice president for credit portfolio management. “Walking away from a mortgage is bad for borrowers and bad for communities and our approach is meant to deter the disturbing trend toward strategic defaulting. On the flip side, borrowers facing hardship who make a good faith effort to resolve their situation with their servicer will preserve the option to be considered for a future Fannie Mae loan in a shorter period of time.”

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

Troubled borrowers who work with their servicers, and provide information to help the servicer assess their situation, can be considered for foreclosure alternatives, such as a loan modification, a short sale, or a deed-in-lieu of foreclosure. A borrower with extenuating circumstances who works out one of these options with their servicer could be eligible for a new mortgage loan in three years and in as little as two years depending on the circumstancesHere is the verbiage from the FN Bulletin:

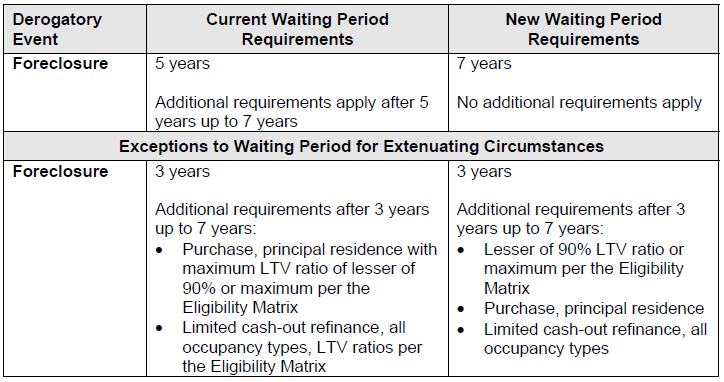

Currently, the waiting period that must elapse after a borrower experiences a foreclosure is seven years. However, Fannie Mae allows a shorter time period – five years – if certain additional requirements are met (e.g., minimum down payment and credit score, and occupancy requirements).

These requirements are being modified to remove the five year option. Unless the foreclosure was the result of documented extenuating circumstances, which only requires a three-year waiting period (with additional requirements), all borrowers will now be required to meet a seven-year waiting period after a prior foreclosure to be eligible for a new mortgage loan eligible for sale to Fannie Mae“

Don’t miss the section that says borrowers who have extenuating circumstances may be eligible for new loan in a shorter timeframe.

by J. Craig Anderson The Arizona Republic Jun. 24, 2010 12:00 AM

A small number of Arizona homeowners facing foreclosure could receive significant aid - reducing what they owe by $100,000 or more - under a state-run program approved Wednesday.

The Arizona Department of Housing got a green light from Washington, D.C., for a plan to use $125 million, its portion of federal funds allocated in February to help the nation’s hardest-hit housing markets.

Arizona’s program could slash mortgage balances for 1,850 households, three-fourths of them in Maricopa County.

The approach is far too small in scale to stabilize the state’s housing market, officials said. But they hope it will spur further action from government and lenders on cutting mortgage principal to keep homeowners in their homes. The plan would go much further than existing government efforts in its attempt to make mortgages affordable.

The state will issue borrowers loans of up to $50,000 to apply to their mortgage balances. Their lenders will be expected to match or exceed that amount.

These “soft” loans would not likely have to be repaid, at least not in full, under the terms of the plan.

Homeowners would have to repay portions of the loans if the home appreciated or was sold during a 10-year period.

The program also would:

• Give lenders incentives of up to $5,000 to settle second mortgages for up to 1,500 homeowners.

Those loans have complicated many borrowers’ attempts to modify their mortgage payments or complete short sales, in which they sell for less than what they owe but avoid foreclosure.

• Give up to $12,000 in temporary aid to as many as 1,000 households that have suffered reduced incomes.

The plan, dubbed “Save My Home AZ,” is expected to launch in September.

As a trial run for potentially broader mortgage-relief programs, state officials said, it will blaze into largely uncharted loan-modification territory.

“What we’re hoping is that, if it’s successful, Treasury would provide more funding for it,” said Carol Ditmore, the Housing Department’s assistant deputy director of operations.

But with as many as 50,000 foreclosures expected to occur in Arizona this year, Save My Home AZ’s direct impact would be minimal, officials said.

It also shares some of the drawbacks that have plagued other government-run housing-relief efforts. It imposes strict eligibility requirements, meaning many homeowners at risk of foreclosure won’t qualify for help.

And its biggest hurdle is that it relies on the optional participation of lenders to match the cuts in principal.

Big mortgage lenders including Bank of America, which holds a significant portion of Arizona’s troubled mortgages, have largely refused to reduce principal for borrowers seeking loan modifications.

MaryJane Rogers, spokeswoman for Chase Home Lending, a JPMorgan Chase & Co. subsidiary, said the company had not yet decided whether to participate in the Arizona program.

“We are committed to helping customers avoid foreclosure and are currently reviewing the details of the Arizona plan,” Rogers said.

Ditmore said the Housing Department has engaged in several discussions with BofA, the country’s largest mortgage lender, adding that bank officials have expressed their willingness to reduce loan principal for eligible participants.

BofA did not respond to phone and e-mail messages seeking comment Wednesday.

The program comes relatively late in the foreclosure crisis.

It is scheduled to conclude in June 2013, according to a proposal the state Housing Department submitted to Treasury officials earlier this year.

That’s around the time many housing experts expect foreclosure activity to return to a historically normal level.

The $125.1 million in funding is part of $1.5 billion in Treasury Department funds.

Shared with California, Nevada, Florida and Michigan, the funding is known as the State Housing Finance Agencies “Hardest Hit Fund.”

Treasury officials plan to distribute an additional $600 million to North Carolina, South Carolina, Ohio, Oregon and Rhode Island to help states with unemployment rates exceeding 12 percent.

Arizona Attorney General Terry Goddard filed a lawsuit Wednesday against Discount Mortgage Relief and Mortgage Relief LLC in Scottsdale, alleging its principals engaged in deceptive loan modification services that may have duped thousands of victims.

The Attorney General’s Office also secured a temporary restraining order to prevent the Scottsdale companies that do business under both names from charging or receiving money for loan modification services or advertising their services.

The lawsuit alleges that, at least since July 2009, the mortgage companies have deceived consumers into paying thousands of dollars for mortgage loan modification services by misrepresenting their ability to help those consumers obtain mortgage relief and save their homes, a violation of the Arizona Consumer Fraud Act.

Consumers allegedly paid Discount Mortgage Relief and Mortgage Relief approximately $1,350 to $5,000 each for loan modification services and were guaranteed results.

John Common, who is named in the lawsuit, disagrees with the AG’s assertions and said his company is being unfairly scrutinized.

“To target every company just because they have ‘mortgage’ or ‘modification’ in their name is unfair,” said Common, a manager of the company.

He described the FBI and local law enforcement search as a “shoot first, ask questions later” affair.

“They need to show something for those efforts,” said Common.

Also named in the lawsuit were Bruce Spurlock and both men’s wives.

The lawsuit alleges Discount Mortgage Relief and Mortgage Relief violated the Arizona Consumer Fraud Act by:

• Misleading consumers into believing they were prequalified and guaranteed to receive a loan modification through the company’s services.

• Falsely promising favorable results and telling consumers that any foreclosure proceedings against their homes would stop once they hired the company.

• Misrepresenting that the company used attorneys to negotiate consumers’ loan modifications.

• Falsely stating that they were associated with or acting on behalf of the government and associated with or acting on behalf of the consumer’s lender.

• Falsely stating that the company was “FBI certified.”

• Misrepresenting the nature of the company’s loan modification services by referring to them as forensic loan documentation audits or analyses.

• Falsely promising consumers their fees would be refunded if the company failed to get them a loan modification, and failing to return fees to some consumers who decided not to hire the company and never signed a contract.

Common said the company’s television commercials make no such claims, and the number of complaints cited in the lawsuit represent only 3 percent of its clients.

“Ninety-seven percent is not a bad score,” he said, arguing that many of the claimants are financially challenged and may act or say things they normally wouldn’t.

Discount Mortgage Relief and Mortgage Relief operate from a 129,000-square-foot office at 14000 N. Pima Road. They employ 134 people.

In the lawsuit, Goddard asks the court to order Discount Mortgage Relief/Mortgage Relief to:

• Refrain from violating the Arizona Consumer Fraud Act.

• Pay full restitution to all homeowners who paid Discount Mortgage Relief/Mortgage Relief for loan modification services.

• Pay a civil penalty of up to $10,000 for each violation of the Arizona Consumer Fraud Act.

• Reimburse the Attorney General’s Office for its costs in this matter.

Goddard said he is committed to fighting deceptive practices targeted at homeowners who are struggling to make their payments.

“Instead of providing assistance, many loan modification companies have been pocketing large up-front fees and failing to obtain any kind of mortgage relief for homeowners,” he said in a prepared statement. “In this past legislative session, my office championed the passage of (Senate Bill) 1130, which prohibits foreclosure consultants from receiving fees before they provide loan modification or other services.”

That law prohibiting consultants from collecting up-front fees takes effect July 29.

A hearing is scheduled for Friday, when the Maricopa County Superior Court will determine whether the temporary restraining order should remain in effect.

by J. Craig Anderson The Arizona Republic May. 26, 2010 12:00 AM

Michael Schennum/The Arizona Republic A home is advertised as a short sale this month in Phoenix. While the short-sale process has been seen as a rocky and difficult experience for buyers and sellers alike, banks now hope speeding the transactions will help alleviate confusion and disappointment.

For a financially struggling homeowner, the decision to pursue a short sale does not come easily.

Homeowners who make that choice generally do so after months of searching and pleading for an alternative that would have kept them in the home.

Even when it goes smoothly, the short-sale process is painful for sellers. When it’s bumpy and slow, the pain is far worse, said experts who met in Tempe this month for an educational conference on short sales.

Far too many short sales have been plagued by false starts, confusion, delays and disappointments, they said.

Phoenix-area short-sellers’ many encounters with insult upon injury stem from a combination of problems, including sellers’ lack of experience with the process and lenders’ initial reluctance to adopt on a mass scale what they had long considered an obscure means of resolving bad mortgage debts.

Scottsdale resident Mary Purvis, 57, said Bank of America finally approved her short-sale application after 10 months of frustration and uncertainty.

But the pain didn’t stop there.

“The sale finally went through last September, but now BofA reported my short sale as a foreclosure on my credit reports, which I have no idea how to fix,” Purvis said.

Big mortgage lenders such as Bank of America and Wells Fargo are still smoothing out the wrinkles in their respective solutions to making short sales faster and more reliable. But they are now taking short sales

very seriously and have made many improvements, one bank representative said.

Just as the average Valley homeowner never imagined losing a home to financial hardship, the average mortgage lender never dreamed the bank would have to set up an assembly line to churn out short-sale approvals.

Purvis did not attend last week’s conference to confront her lender directly, but Charlotte, N.C.-based Bank of America’s Matt Vernon, the bank’s top executive in charge of foreclosures and short sales, was there to face a roomful of like-minded consumers.

Vernon was quick to admit the bank’s flawed handling of short sales, but he said Bank of America has since taken a 180-degree turn.

It has implemented an automated system - the first of its kind - for tracking the progress of short sales and has reduced the average number of days it takes for a short-sale to be approved, from 90 days to just over 50 days.

The bank approved 18,000 short-sale applications in April, Vernon said.

Unfortunately, it received more than 50,000 short-sale applications that month.

“Our system was never designed to handle this kind of volume,” said Rick Sharga, senior vice president and chief economist at RealtyTrac, based in Irvine, Calif., which collects and analyzes nationwide data on short-sales and foreclosures. “Short sales were never intended to be a mass-market product.”

That’s exactly what they have become, said Sharga, who spoke Friday at a Tempe conference organized by the Distressed Property Institute, a San Diego-based business that has developed a certification and training program

for real-estate agents and other buyer and seller representatives in short-sale transactions.

Company founder and CEO Alex Chafen said the institute’s twofold purpose is to teach real-estate professionals how to be more effective at negotiating short sales, while giving homeowners who need representation a way to separate the short-sale experts from the novices.

The company created a special designation, Certified Distressed Property Expert, which it hopes will become synonymous with short-sale expertise.

What is a short sale?

In a short sale, a homeowner seeks to sell the home for less than the amount still due on the mortgage. All lenders with a lien on the mortgaged home must agree to the short sale’s terms, because they will not be compensated for the full amount of the mortgage when the home sells.

Tips for prospective short sellers

• Do not wait until foreclosure is imminent to initiate a short sale.

• The seller’s agent bears the brunt of responsibility for making sure the sale is completed. When choosing an agent, ask for references from previous short-sale clients and other proof of expertise, such as Certified Distressed Property Expert certification.

• Be prepared to prove financial hardship. Lenders usually require the two most recent tax returns, bank statements, loan statements, pay stubs or other proof of income, along with a hardship letter explaining your circumstances, a detailed description of the home’s current condition, closing documents from the home purchase and authorization for your representative to negotiate with the lender.

• Contact the primary mortgage lender for instructions on submitting a short-sale application. Be sure to include every document the lender requires.

• The seller or representative should call the lender every day until a short-sale negotiator is assigned, and then call the negotiator every day until he or she orders an appraisal or broker price opinion of the home’s value.

• With an appraisal and comparable buyer’s offer in hand, negotiate with the lender for approval

.The federal government’s 15-month-old home-loan modification program has not been the foreclosure rescue plan many Phoenix-area homeowners expected.

Slow lender response, piles of paperwork and drawn-out trial periods have frustrated many struggling homeowners. more…

![]()

![]()

Freddie Mac released its financial reports for the first quarter of 2010 showing a net loss of 6.7 billion and announced that its Conservator, the Federal Housing Finance Agency (FHFA), will be asking the Department of the Treasury for a draw of $10.6 billion under the Senior Preferred Stock Purchase Agreement. more…

![]()

![]()

On Tuesday the House Financial Services Committee approved a request by the Federal Housing Administration (FHA) to raise the ceiling on annual FHA mortgage insurance premiums from its current level of 0.55 percent.

FHA had requested the increase as one part of a plan aimed at shoring up its capital reserves which have dropped below the 2 percent required by law. The agency already raised the up-front premium charged to borrowers closing effective April 9. If the full Congress approves the annual increase, FHA will then shift some of the upfront premium to an annual premium to reduce the burden on borrowers at closing. more…

Hairdresser Robin Corey had to wait nearly five decades, but the Chandler woman this month finally became a homeowner.

Corey, 49, is a single mother who has worked as a hairdresser for 31 years. She’s been fortunate enough to keep a job and provide for her son, but she never thought she’d make enough money to own a house. more…

Financially distressed residents are learning the hard way that they can’t walk away from homeowners-association assessments - even if their homes are in foreclosure or part of a bankruptcy.

Increasing numbers of lawsuits seeking delinquent HOA dues, fines and legal fees are making their way through Maricopa County Justice Courts, where defendants are often surprised to find out that as long as their name is on the property deed they’re responsible for mounting HOA fees. more…

![]()

![]()

As a result of the housing collapse, many Arizonans have seen their homes lose half of their value. Many owe several hundred thousand dollars more than their homes are worth and are unlikely to dig out of their negative equity hole for decades.

For these homeowners, the American dream has become a nightmare - and their financial future is dim. more…

![]()

![]()

Phoenix-based Radical Bunny LLC has been ordered by the Arizona Corporation Commission to pay $189.8 million in restitution to its investors.

After a 22-month investigation, the commission has found that Radical Bunny fraudulently sold unregistered deed-of-trust investments. The group, which raised money from almost 900 investors and then lent it to Mortgages Ltd., was not registered as a securities dealer. more…

Summary: Forensic Mortgage Loan

Audit Review May Be Latest Scam

There are all types of scam artists out there. Sometimes it’s hard to tell the difference between legitimate companies and scam artists.

There are people out there claiming to be forensic mortgage loan auditors. These people have expertise in the rules and regulations governing mortgage loans and if a lender has failed to comply with federal or state laws governing mortgage loans, you might benefit from their services. But not everybody benefits. Particularly if the forensic auditor requires a hefty upfront payment for services. As with any service out there, make sure you check the company out and never pay anybody anything until they are able to successfully obtain what they have promised you. The more you know and learn, the better off you will be. more…

![]()

![]()

WASHINGTON - Two former Fannie Mae executives said Friday that competitive pressures, combined with the political goal of increasing homeownership, were to blame for the company’s decision to back riskier mortgages that fueled the housing bubble.

Daniel Mudd, Fannie Mae’s former chief executive, and Robert Levin, former chief business officer, testified before a panel examining the roots of the financial crisis. Both executives left Fannie Mae after it was seized by regulators in fall 2008. more…

![]()

![]()