Those computer-enhanced images are yellowing now. Some of the Northeast Valley projects have stalled and the optimism and free-flowing investment cash of the era before 2008 seem like a mirage.

Unearthing the publicity pamphlets recently, while cleaning my desk, took me down a memory lane of hope and hype.

Nordstrom, Bloomingdale’s and Macy’s were touted to open at CityNorth by 2011.

Westcor promoted plans for 190-foot condos and a shopping center with a retractable roof at Palisene northwest of Loop 101 and Scottsdale Road.

Across the road to the east, DMB Associates heralded designs for its One Scottsdale project with 1,100 residential units, 400 hotel rooms and 1.8 million square feet of shopping, dining and office space.

Henkel AG did open its North American headquarters on DMB’s 120-acre site in 2008, but One Scottsdale’s other buildings have not made it off the drawing board.

Scottsdale Canal Development spent tens of millions of dollars buying and rezoning land for its Solis Scottsdale Resort and Residences northeast of Scottsdale and Camelback roads. It bulldozed aging apartments.

Developers paid for an economic study that projected Solis Scottsdale would generate $3.7 million in city tax revenue in its fourth year.

Four years after the plans surfaced, the Scottsdale Canal Development property is up for bid today in a foreclosure sale.

Bad timing

Timing is everything in music, comedy and development. And these projects got caught on the downbeat of the development cycle that followed a crippling recession and still recovering financial markets.

Projects around the Valley are trying to rebound from bad timing, bad plans or both. That includes the former Centerpoint condo towers in Tempe, Elevation Chandler and CityNorth, three projects that are among the biggest belly flops.

CityNorth, which opened in November 2008, just months after the economic crisis hit, was sold at a foreclosure sale in July 2010. The three anchor department stores and scores of smaller shops and restaurants have pulled out.

Westcor is pursuing development of a luxury outlet mall at Scottsdale Road and Loop 101 that would open early in 2013. The company is not saying if it would be built at Palisene on the Phoenix side of Scottsdale Road or at One Scottsdale to the east.

Westcor and DMB in March 2008 agreed that Westcor would develop the retail at One Scottsdale.

Charley Freericks, DMB general manager of commercial real estate, said One Scottsdale would welcome the Fashion Outlets of Scottsdale, but Westcor has not disclosed its intended location for the project.

In the meantime, other interests are “kicking the tires” at One Scottsdale and the company is feeling optimistic about landing some deals, he said.

One Scottsdale has been on hold for the past few years, but it’s in a better position than CityNorth, Freericks said.

“We’re starting with a clean slate as the economy comes back to life,” he said.

Apartments lead recovery

Paul Katsenes, Scottsdale community and economic development director, said retail development at Scottsdale Road and Loop 101 “would be taking an enormous beating right now” if it had gone forward a few years ago.

Scottsdale Quarter, about 2 miles away, has done really well under the circumstances, he said.

“There is a unique character about retail that it’s the last real-estate component to come out of a bad economy,” said Katsenes, adding that apartments are the first to emerge.

Indeed, apartment projects are so hot right now that it should suggest some caution to avoid overdevelopment.

As the market recovers, it’s good to keep some perspective and remember all those pretty pictures from five years ago.

Recession’s victims

Here are some of the higher-profile development projects in the Northeast Valley that stalled or were derailed by the recession:

• CityNorth, the mixed-use project at 56th Street and Loop 101.

• Palisene, Westcor’s planned regional mall northwest of Scottsdale Road and Loop 101.

• One Scottsdale, DMB Associates’ mixed-use project northeast of Scottsdale Road and Loop 101.

• Solis Scottsdale, hotel and luxury condominiums northeast of Scottsdale and Camelback roads.

• Portales Place, a former Grace Communities condo project at Goldwater Boulevard and Highland Avenue.

by Peter Corbett The Arizona Republic Sept. 2, 2011 06:33 AM

WASHINGTON - The federal government’s largest housing construction program for the poor has squandered hundreds of millions of dollars on stalled or abandoned projects and routinely failed to crack down on derelict developers or the local housing agencies that funded them.

Nationwide, nearly 700 projects awarded $400 million have been idling for years, a Washington Post investigation found. Some have languished for a decade or longer even as much of the country struggles with record-high foreclosures and a dramatic loss of affordable housing.

The U.S. Department of Housing and Urban Development, which oversees the nation’s housing fund, has largely looked the other way: It does not track the pace of construction and often fails to spot defunct deals, instead trusting local agencies to police projects.

The result is a trail of failed developments in every corner of the country. Fields where apartment complexes were promised are empty and neglected. Houses that were supposed to be renovated are boarded up and crumbling, eyesores in decaying neighborhoods.

In Inglewood, Calif., a sprawling, overgrown lot two blocks from city hall frustrates senior citizens who were promised a state-of-the-art housing complex more than four years ago. Although the city invested $2 million in HUD funds, the developer doesn’t have the financing to move forward.

In Newark, N.J., two partially completed duplexes sit empty in a neighborhood blighted by boarded-up homes lost to foreclosure. The city paid nearly $400,000 to build the houses, but after a decade of delays, the developer folded and never finished. The money has not been repaid.

In Orange, Tex., 35-year-old laborer Jay Breed lives next to a dumping ground littered with tires and other trash, where a non-profit developer was supposed to build 50 houses for the poor. Five years later, with $140,000 in HUD money gone, no homes have gone up.

“It’s a wasteland,” Breed said.

The Post examined every major project currently funded under the HUD program, analyzing a database of 5,100 projects worth $3.2 billion, studying more than 600 satellite images and collecting information from 165 housing agencies nationwide.

The yearlong investigation uncovered a dysfunctional system that delivers billions of dollars to local housing agencies with few rules, safeguards or even a reliable way to track projects. The lapses have led to widespread misspending and delays in a two-decade-old program meant to deliver decent housing to the working poor.

The Post found breakdowns at every level:

• Local housing agencies have doled out millions to troubled developers, including novice builders, fledgling nonprofits and groups accused of fraud or delivering shoddy work.

• Checks were cut even when projects were still on the drawing boards, without land, financing or permits to move forward. In at least 55 cases, developers drew HUD money but left behind only barren lots.

• Overall, nearly one in seven projects shows signs of significant delay. Time and again, housing agencies failed to cancel bad deals or alert HUD when projects foundered.

• HUD has known about the problems for years but still imposes few requirements on local housing agencies and relies on a data system that makes it difficult to determine which developments are stalled.

• Even when HUD learns of a botched deal, federal law does not give the agency the authority to demand repayment. HUD can ask local authorities to voluntarily repay, but the agency was unable to say how much money has been returned.

The national capital region has a particularly troubled track record. In suburban Prince George’s County, Md., the non-profit Kairos Development Corp. received $750,000 in 2005 to build dozens of homes. Six years later, Kairos has not built a single house.

Dozens of housing agencies nationwide acknowledge botched deals and often blame the economy for leaving developers without financing to finish the work.

But hundreds of stalled projects predate the troubled financial markets, with developers tapping HUD’s program for easy money and then escaping even rudimentary oversight from local and federal authorities. The agency’s inspector general for years has chronicled scores of delayed projects and millions in waste.

“We need to reduce the risk for HUD funding in development deals,” said Annemarie Maiorano, who manages HUD money for Wake County, N.C. “There needs to be basic standards.”

HUD officials said they have recently tried to determine why developments are delayed and have begun to cancel projects. In response to inquiries from the Post, the agency last month launched investigations into a series of defunct deals, finding questionable payments and excessive delays, and in recent weeks has sought the return of more than $4 million from housing agencies in the District of Columbia and Prince George’s County.

“We can do better and we will,” said Mercedes Marquez, HUD’s assistant secretary for community planning and development, who was nominated by President Barack Obama in 2009. “HUD, the Congress and every taxpayer I know expects these funds to be put to work. … I won’t hesitate to do what’s necessary.”

The Post’s investigation is the first systemic look at the progress of construction in HUD’s affordable-housing fund, known as the HOME Investment Partnerships Program.

The program launched with great promise two decades ago, when Congress vowed to fund the construction or renovation of thousands of apartments and houses for working-poor families.

HUD’s money typically doesn’t cover all construction costs. The program is meant to provide partial funding for developers who are expected to draw additional financing from banks and other sources.

But hundreds of current projects have faced years-long delays, with a similar pattern playing out in city after city.

Behind many of the deals are developers who didn’t have land, permits, financial capacity or commitments for private financing. HUD has few underwriting standards: Housing agencies are required to ensure that developers have a proposed budget and construction schedule - but not proof that they have the money to start building.

Other developers have had little housing experience or were dogged by foreclosures, cost overruns, liens and allegations of defective work.

by Debbie Cenziper and Jonathan Mummolo Washington Post May. 15, 2011 12:00 AM

Historically, the real-estate industry has lagged behind the rest of the business world by a few years in the adoption of new digital tools.

But the housing-market downturn appears to have spurred agents, brokers and others to develop and embrace new technology at an unprecedented rate.

From Facebook to QR codes, to Twitter and multiple custom websites, many agents have come a long way from the days when they jumped in the car carrying printouts of home listings and the latest local street map.

5 key technologies for real-estate agents

Bob Bemis, chief executive of the Arizona Regional Multiple Listing Service, said Arizona real-estate agents have adjusted quickly in terms of their attitudes toward adopting new technology.

“The explosive nature of technical development has been phenomenal,” said Bemis, who has helped promote that change by offering a variety of technology products to listing-service members.

To some extent, it’s unclear where the changes will lead. The worst housing slump in generations came along just as smartphones, social media and other devices were starting to transform the way real-estate business was conducted.

The flood of short sales and foreclosures, not to mention many recent changes in rules and procedure, have required agents to learn new processes and techniques with all the latest tools at their disposal.

Even after the housing market returns to normal, those in the real-estate industry said technology was likely to continue changing their profession in unpredictable ways.

The agent’s role in a home sale - that of buyer or seller representative - is no different, according to real-estate agents in the Phoenix area. But there has been a significant uptick in the knowledge and tools required to do the job effectively.

Rampant change is partly a product of the economic downturn and financial distress many homeowners have endured and partly the result of new information technologies that, depending on how they are used, can be regarded as either a boon or a threat to the real-estate industry.

Most agents and brokers seem to agree their industry is likely to undergo as many changes in the next four years as it has during the previous four.

They said the impact of high-tech tools such as broadband wireless service, Internet data exchange, digital social networking, global-positioning systems and quick-response codes for smartphones had been overwhelmingly positive.

Still, industry representatives said information technology also has the potential to diminish real-estate agents’ role in the housing economy via a process known as “disintermediation,” which is a fancy way to say “cutting out the middleman.”

It’s the same process that has wreaked havoc on travel agents, discount stockbrokers and other professional intermediaries.

“At this point, the threats are not huge,” said Ron LaMee, senior vice president of information services for the Arizona Association of Realtors. “It may carve out pieces of the traditional services that agents provide.”

Agents of change

Today’s real-estate agents operate in an environment in which sales transactions have gotten more complicated, mortgage-lending standards are tighter, the home-appraisal process stricter, and the federal government is constantly changing incentives and restrictions that can save or kill a deal.

Many agents have incorporated technologies into their businesses that allow clients to perform some of the more enjoyable work themselves, such as searching through online home listings, while their agent focuses on the heavy lifting.

Every geographic area in the country has a listing service that maintains a Web-based database of homes available for purchase, along with various details about each property. Some of the information is suitable for public consumption, such as a home’s square footage, while other information is not, such as the lockbox combination to house keys for agents to use when showing a home to clients.

One of the listing service’s major accomplishments in recent years has been developing a Web-based system that lets consumers access and search the public-approved portion of the database.

Bemis has gone on to transform the Phoenix-area listing service into what he calls “a tester and recommender of new technology” for agents.

Bemis said most agents felt pressure to keep up with new technology, but that there could be as many as 50 to 100 applications with the same basic function available on the market.

Generally, real-estate agents are looking for tools that enhance their self-promotion efforts, improve relationships with clients, gauge buyer interest in their listed properties and the track the progress of pending home purchases. Agents have adopted other technologies out of sheer necessity, such as electronic systems lenders have implemented to track the progress of short-sale transactions.

Bemis said competition among agents is more intense than ever, and that any tool which provides a slight edge over the competition is too important to ignore.

“Those that want to survive have to evolve much, much more quickly,” he said.

Apps for agents

High-tech entrepreneurs John Perkins and Grant Gould have spent the past several years developing applications designed to perform certain tasks specifically for real-estate agents.

Co-founders Gould and Perkins’ latest venture, Home Junction Inc., based in La Jolla, Calif., offers a proprietary software product called SpatialMatch that allows users to choose a neighborhood and then view an interactive map showing anything they want to see: schools, public parks, parking garages, bus stops, bagel shops, haberdashers, Whataburgers - anything.

Agents subscribe to a service that lets them embed the SpatialMatch interface on their own websites using a technology known as Internet data exchange, or IDX.

IDX lets visitors to the website use the embedded application without having to link to another site. Many real-estate agents use the same technology to let clients access the listing service’s database.

Gould and Perkins give their agent clients the option of putting the SpatialMatch app behind a lead-generation barrier, which forces visitors to enter their name and contact information.

However, they said few agents use it. Agents have learned by experience that the hard sell and the Internet don’t mix.

“It’s not about lead-generation,” Gould said. “It’s about managing the flow of information to the consumer.”

Unfettered access to apps such as SpatialMatch keep visitors on the website and position the agent as a hyper-local expert, they said.

A previous business Gould and Perkins developed, Real Estate Village, helped agents create custom websites and was sold in 2005 to Homes.com, which provides a variety of Internet-based services to real-estate agents.

Perkins explained that tech tools in the real-estate business usually have one of two opposing goals: automation or disintermediation.

Automation products aim to make the job easier for agents. Disintermediation products aim to make agents obsolete.

Because they offer the application only to real-estate professionals, Perkins and Gould said they are in the automation space.

In fact, their goal is to help agents and brokers compete against the leaders in disintermediation, do-it-yourself home listings Web portals such as Realtor.com, Zillow and Trulia.

“We made a conscious decision to develop products that empower the Realtor,” Gould said.

Too much tech?

In today’s real-estate market, the use of certain high-tech products and services is mandatory, said Laurie Duffy, a real-estate agent with John Hall & Associates Inc., based in Phoenix.

The most critical among them is a quality website devoted specifically to that particular agent.

All real-estate agents are independent contractors, she said, and they succeed or fail based on the strength of their personal branding effort.

“You really have to set yourself apart from other agents by putting your name out there,” she said.

Other must-have technologies include text messaging, a Facebook page, a GPS device, and a laptop computer with wireless Internet service.

One of the most promising technologies to hit the real-estate profession in recent months is the use of quick-response codes, or QR codes, said Realty Executives agent Libby Cohen, of the Scottsdale-based Walt Danley Group.

Cohen demonstrated recently how she uses QR codes, which look like squares partially filled in with black dots, on the front of her listed homes’ for-sale signs.

Any passer-by with a compatible smartphone can scan the code with the phone’s camera, which instantly sends the phone’s Web browser to a page featuring information about the home and even a video tour.

Cohen receives a notice whenever one of her QR codes is scanned, allowing her to track the number of visitors to each property.

She said the system helps her maintain a good relationship with sellers.

Duffy said there were some things she prefers to do the old-fashioned way, and that too much technology can be a bad thing.

Whenever possible, Duffy said she chooses face-to-face conversation over a phone call, and a phone call over an e-mail message.

While Duffy agreed that the role of real-estate agents was bound to continue evolving with new technology, she scoffed at the notion that a website ultimately could displace agents altogether.

“I don’t see how the Internet could ever take the place of an agent,” she said. “People need guidance, and they need it from an actual person.”

Agents of the future

LaMee agreed that real-estate agents always would have a place in the housing market.

A home purchase is far more complicated than buying plane tickets or shares of Motorola, he said, adding that real-estate agents are unusual in that they broker transactions between two consumers.

Still, LaMee said it was likely that real-estate agents of the future would be fewer, more specialized, more productive and able to provide a no-frills version of their services for a reduced fee.

Limited-service real-estate agencies, often charging a flat fee in place of the traditional 3 percent commission, already had begun to emerge toward the end of the housing boom, LaMee said, but the downturn seemed to have put the brakes on that trend.

As much as real-estate agents hate them, complicated and potentially frustrating short-sale transactions now prevalent in the Phoenix-area housing market have made full-service agents vital again, especially to sellers.

Many agents believe the reprieve from their devaluation is only temporary, however.

A survey of agents and brokers conducted recently by Web-based real-estate news service Inman News revealed that many believe flat-fee services are most likely on the rise again.

The online survey, whose respondents included more than 700 self-identified agents and brokers, and about 300 other real-estate professionals, was conducted between February 2009 and March 2011.

Only about 12 percent of respondents said they currently offer services for a flat fee, but 36 percent said they expected flat-fee services to become more popular in the next five years.

The devaluation problem appears more advanced when it comes to the services provided by sellers’ agents, who often do the lion’s share of work in a typical short sale.

The survey found that while the bulk of buyers’ agents still claim to be receiving the standard 3 percent commission, more often than not sellers’ agents are getting less than that, about 2.5 percent.

Not surprisingly, the number of licensed agents and brokers statewide has declined almost 22 percent since 2007, just after the Valley’s housing market peaked.

Roughly 51,000 agents and brokers remain in the state, according to recent figures from the Arizona Department of Real Estate, down from more than 65,000 in 2007.

LaMee said that thinning of the ranks is bound to continue in the foreseeable future.

Therefore, the next generation of high-tech tools for agents will have to address productivity concerns in an industry whose participants do more work and get paid less.

by J. Craig Anderson The Arizona Republic May. 15, 2011 12:00 AM

After considerable pain, downsizing and nearly $1 billion in cumulative losses, Arizona’s native banks finally might be turning the corner.

The 37 banks still based in the state just wrapped up their best quarter since the financial crisis and recession began, breaking a string of 12 straight quarters during which the majority of institutions here lost money.

On balance, the local industry is profitable again, albeit by a razor-thin margin that partly reflects the demise of some of the weakest players. Still, bankers are sensing a silver lining in the latest numbers, and they’re not complaining.

“It’s a good story, a change in the weather,” said Stephen Haggard, president and chief executive officer of Metro Phoenix Bank. “The local economy is doing better, with definite improvement from six months or a year ago.”

As local banks recover, that could make more lending dollars available to customers here, especially small businesses, while improving overall banking services and perhaps even reversing the three-year decline in employment at these firms. Healthy local banks also are in a better position to donate to non-profits and support the community in other ways.

Metro Phoenix Bank posted a $624,000 first-quarter profit after basically breaking even one year earlier.

The big news is that bad-loan difficulties are easing, at long last.

“Problem assets have been dramatically reduced,” said Scott Schaefer, president of Meridian Bank, which improved to a $2.9 million first-quarter profit from a loss of $11.1 million a year earlier.

“We took our lumps in 2009 and 2010,” he said, citing write-downs and other responses for dealing with problem loans.

The banks headquartered in Arizona earned nearly $20 million combined from January through March, with 19 of the 37 turning a profit, based on a preliminary tally of financial reports supplied to the Federal Deposit Insurance Corp.

The agency will release final statewide numbers later this month.

Many local banks were and remain highly exposed to real-estate lending, since that industry was the state’s main growth catalyst for so many years.

The Arizona totals exclude figures for banks that operate here but are based elsewhere, such as the three largest companies with an Arizona presence - Wells Fargo, Chase and Bank of America.

They also don’t include banks that have failed, merged or been acquired over the past few years.

The majority of local banks have been running in the red for the past three years, hammered by real-estate setbacks and hemorrhaging the capital that regulators require for them to stay in business.

At the nadir in late 2009, 84 percent of Arizona’s banks were unprofitable.

Combined, Arizona’s local banks lost $950 million across 2008, 2009 and 2010.

Since the end of 2007, the state has lost 20 banks through failure, merger or acquisition and shed more than 1,500 related jobs.

Also, market share has become more concentrated in the hands of the big out-of-state entities that, critics say, are less motivated to lend locally.

“Local banks will reinvest the money in small businesses,” said Ernest Garfield, president of Independent Bank Developers of Scottsdale and a former Arizona state treasurer and Corporation Commission member.

“The big banks will drain it out of the state.”

Bankers at large institutions contest that claim, but it’s clear that having more healthy entities increases the availability of local loan dollars.

The improved recent numbers for local banks don’t mean all is well. Some of the weakest banks in Arizona and nationally continue to struggle.

The FDIC’s list of “problem” banks is still rising, with one in nine institutions nationally and an untold number in Arizona under close scrutiny. The agency doesn’t name banks on its list out of concern for inciting runs by depositors.

The FDIC generally insures depositors up to $250,000 per bank.

Small community banks that represent the backbone of Arizona’s industry have been hit harder than larger national banks, which have more diversified operations.

The U.S. industry actually remained profitable throughout the slump and earned $87 billion in 2010 - almost back to pre-recession levels.

Arizona banks, as noted, have been heavily dependent on real estate.

Perhaps the main reason banks in Arizona and elsewhere are reporting better numbers is that loan problems and delinquencies are easing, so banks don’t have to increase their reserves to cover losses.

When banks must boost reserves, that eats into profits and capital.

Also, banks are earning higher spreads between what they generate on loans and pay on deposits, and they’re earning more in fee income, Haggard said.

Schaefer sees opportunities for well-positioned banks but cautions that metro Phoenix’s economic recovery remains “spotty.”

Haggard is more optimistic. While real estate remains depressed, prices aren’t dropping as fast as before, he said.

Also, borrowers in other industries generally are faring better.

“The financial reports we’re receiving from clients are showing stronger cash flow and top-line revenue numbers,” he said.

Garfield feels now is a great time to start a bank in Arizona, reflecting the decreased competition, gradual improvement in the economy and other factors.

“Also, bankers have finally learned what gets them in trouble,” he said.

Add it all up and there are reasons for optimism.

Local banks focus their lending within Arizona and thus are a key cog in the economic-development machine.

If they have finally turned the corner, that could be a good indicator for everyone in the state.

by Russ Wiles The Arizona Republic May. 15, 2011 12:00 AM

Phoenix-area residents don’t need to hang out on the courthouse steps in downtown Phoenix to get a detailed view of what’s happening at Maricopa County’s daily trustee’s sale auctions, where homes either get bought by competing bidders or become bank-owned property.

California-based Foreclosure Radar has been gathering and reporting a variety of data on foreclosure auctions in major metro areas including Phoenix.

The company from Discovery Bay operates a Web portal partly reserved for paying clients, but the free and publicly accessible areas offer much information at foreclosureradar.com.

The site’s Maricopa County page tracks several aspects of area foreclosure sales, such as the percentage of properties that become bank-owned because no third parties bid on the property or because the minimum price was too high.

It provides a breakdown of lender repossessions, sales to third-party buyers, the average opening bids and winning bids, the average length of time it took to complete a foreclosure, and more.

For example, the average time it took to foreclose on a home in Maricopa County in March, the most recent month available, was 191 days - more than twice the minimum notice requirement of 90 days. That’s up 33 percent from the average of 144 days in March 2010, according to ForeclosureRadar. The website also analyzes monthly foreclosure totals based on factors including property size, amount of mortgage-principal owed and the year the mortgage loan was issued. Of the 5,606 homes foreclosed on in March, the largest number had loans issued in the second quarter of 2007 (828 homes), followed by homes with loans issued in the first quarter of 2006 (752 homes).

by J. Craig Anderson The Arizona Republic Apr. 17, 2011 12:00 AM

Desert Mountain Golf Club Desert Mountain Golf Club’s Cochise course opened in 1988. Club members recently purchased the club’s assets from Crescent Real Estate Holdings for $73.5 million.

Members of the exclusive Desert Mountain Golf Club in north Scottsdale have completed a deal with owner Crescent Real Estate Holdings to purchase the club’s six golf courses, all related facilities and about 500 acres of developable land for $73.5 million.

The deal expands on an agreement in the Desert Mountain membership contract that would have required members to buy the club’s six golf courses and clubhouse facilities on March 1.

Member representatives described the expanded deal as an insurance policy against future changes to the club and its surrounding community of multimillion-dollar homes.

Of particular concern, they said, was the large swath of adjacent land, which Crescent ultimately could have sold or developed for any number of residential or commercial projects.

Dave Kaplan, who lives in the Desert Mountain community and has been a member of the club since 1997, said he was not surprised that 99 percent of the members who voted on the purchase deal favored it. Of the roughly 2,300 members, 90 percent cast votes, the club’s managers say.

“I strongly supported Desert Mountain’s global asset purchase, which accelerated the turnover process and ensured the future of our community,” Kaplan said.

It’s no secret that dozens of high-end golf courses have struggled to remain private - or even stay open - in recent years.

Some have addressed the economic problem by opening the fairways to public play.

Superstition Mountain Golf and Country Club, near Gold Canyon in the far East Valley, is one of the area’s formerly private-only clubs that has been pursuing daily-fee golfers by opening up one of its two courses each day to non-members.

Country clubs Red Mountain Ranch in east Mesa, Moon Valley in north-central Phoenix, Corte Bella in Sun City West and Quintero near Lake Pleasant all have altered their policies in recent years to allow some limited use by non-members.

Desert Mountain members’ bigger concern, according to club President Bob Jones, was making sure the community’s vacant land would be developed for purposes that benefited the club and not just the property’s owner.

“They (Crescent) would have maintained control,” Jones said. “They could have sold the land to another developer.”

To make the deal work financially, Jones and other representatives of the buyers’ group obtained financing for a portion of the purchase price.

The upshot of that decision was that instead of each member paying an expected $50,000 over many years via fee increases, each member was assessed a one-time fee of $16,500, which Jones said would be the only contribution ever required of them.

He added that the group performed extensive due diligence before agreeing on the purchase price. The club has turned a profit every year since 2003, Jones said.

He said that the final negotiated price was about one-third of the seller’s original asking price.

“The developer was hoping to get over $200 million from this deal,” he said.

Kaplan said he and the other members knew in advance that they would have to contribute some cash, and that he did not consider the $16,500 a financial burden.

“I thought it was an amount that the majority of members were very comfortable with,” he said.

Desert Mountain Golf Club timeline

1986 - Desert Mountain is established in northeast Scottsdale.

1987 - Renegade, Desert Mountain’s first Jack Nicklaus-designed course, opens.

1988 - The club’s second course, Cochise, opens

1989 - The third course, Geronimo, opens.

1990 - The Cochise-Geronimo Clubhouse opens.

1993 - The Sonoran Clubhouse opens.

1996 - The fourth course, Apache, opens.

1997 - The Renegade Clubhouse opens.

1999 - The fifth course, Chiricahua, opens.

2003 - The sixth and final course, Outlaw, opens.

2010 - Members vote to purchase the club and related assets.

2011 - Ownership is transferred to club members.

Source: Desert Mountain Golf Club

NEW YORK — The Obama administration outlined three options Friday to change the way home loans are financed, calling for the slow death of mortgage giants Fannie Mae and Freddie Mac and jumpstarting the debate over the future role of government in helping borrowers secure mortgages.

If implemented, the proposals would likely make it more expensive for borrowers to buy a home and thus restrict the availability of mortgages. It also marks a significant departure from past government policies, which treated homeownership in America as a virtual right.

“The government must…help ensure that all Americans have access to quality housing that they can afford,” the administration said in its report to Congress, delivered as part of last year’s financial overhaul law. “This does not mean our goal is for all Americans to be homeowners.”

The troubled housing market — a legacy of the deep bust that followed a historic boom in which reckless lending and borrowing led to the most punishing downturn since the Great Depression — led to calls for the federal government to radically reform the way home mortgages are financed. There’s $10 trillion in outstanding home loan debt.

Policy makers, bankers and investors agree that taxpayer-owned Fannie and Freddie should be wound down. But there’s no consensus on what should replace them.

The first option outlined in the report calls for a private system in which lenders and investors fund new mortgages, with a limited role for existing federal agencies to subsidize home loans for the poor and other special groups, like veterans. The second proposal calls for much of the same, but it includes a government backstop for mortgages during times of market stress. If credit markets froze — like they did at the height of the crisis — the government would step in and guarantee new home loans. The third option outlines a much broader government role. Under this alternative, taxpayers would insure securities backed by home loans, which is what Fannie and Freddie already do.

The administration’s outline explained the benefits and costs of the various options, but stopped short of endorsing any of them. Critics will likely say the administration punted.

The 31-page outline says “very little that is surprising or market-moving as it lacks specific details or…any extreme views,” mortgage bond strategists Greg Reiter and Jeana Curro at RBS Securities wrote in a note to clients. They were “mildly surprised” at the lack of details, though.

Analysts at Amherst Securities, led by Laurie Goodman, said in a report that the plan is “largely a non-event.”

Along with federal agencies, taxpayer-owned behemoths Fannie Mae and Freddie Mac guarantee more than nine of every 10 new mortgages. They were effectively nationalized in 2008. Delinquencies on home loans they back have thus far cost taxpayers more than $150 billion. Their regulator, the Federal Housing Finance Agency, estimates Fannie and Freddie could need up to $363 billion in taxpayer cash through 2013, it said in an October report.

“We are going to start the process of reform now,” Geithner said in a statement. “But we are going to do it responsibly and carefully so that we support the recovery and the process of repair of the housing market.”

Geithner said it will take another three years for the housing market to recover. It currently suffers from a high foreclosure and delinquency rate, low levels of homeowner equity, and an abundance of homes for sale without a corresponding number of interested buyers.

After that, it will likely take two to three years for policy makers to come to agreement on the government’s role in funding home loans, Geithner said. The final step calls for new legislation. All told, Geithner said it will take between five to seven years to transition to a new system.

Steps to take during that time to slowly wean the market off total government support largely revolve around making Fannie- and Freddie-backed mortgages more expensive, which would make loans not backed by taxpayers more desirable. This includes increasing the fees Fannie and Freddie charge to guarantee home loans backing securities; pushing them to require homeowners to purchase additional mortgage insurance or put at least 10 percent down; and reducing the size of individual loans that Fannie and Freddie could guarantee.

But while the administration wants to decrease government’s role in funding home loans, it wants to increase federal subsidies for rental housing. Shaun Donovan, the secretary of the Department of Housing and Urban Development, said Friday that half of renters spend more than one-third of their income on housing, and one-quarter of renters devoted more than half, according to HUD research.

Reactions from lawmakers ranged from pleasant surprise to muted displeasure.

Rep. Barney Frank of Massachusetts, the top Democrat on the House Financial Services Committee, praised in a statement the administration’s support for increasing resources directed towards renters, but said it is “not clear” whether lenders and investors alone could support the market in a way that makes mortgages affordable to borrowers.

Rep. Ed Royce, a Republican from California who also serves on the financial services committee, said he was “pleasantly surprised” that the administration wants to wind down Fannie Mae and Freddie Mac.

“The 800-pound gorilla in the room remains the level of government support in the mortgage market going forward,” Royce said in a statement. “On that front, [the Obama administration] decided to punt.”

Rep. Maxine Waters, a California Democrat and another financial services committee member, said she has “concern” that the administration’s proposals “may radically increase the cost of homeownership, and housing in general.”

The theme of the report and subsequent conversations with administration officials stressed the Obama team’s desire to have a smaller government footprint in the mortgage market.

“The report’s takeaway message is that the U.S. housing finance system is likely to undergo major changes going forward, and with the likely outcome being a significantly smaller role for the U.S. government,” analysts at research firm CreditSights said in a note.

The reality is Democrats want continued government support of mortgages backing securities.

A fully privatized system would lead to higher costs for mortgages, but it would also nearly extinguish the risk posed to taxpayers and would enable resources currently devoted to housing to go to more productive channels, benefitting the economy in the long run, the administration noted in a nod to the predominant Republican position.

A hybrid approach that calls for increased government support during times of market stress would enable the government to lessen the social costs from contractions in credit to borrowers. Maintaining government backing of home loans at all times ensures cheap mortgages, thus artificially inflating home prices and allowing resources to continue flowing to housing. This proposal also puts taxpayers on the hook for losses.

But while observers say the administration appears to favor a robust government role — analysts at RBS Securities say government-sponsored entities and federal agencies will likely end up supporting 50-65 percent of the market — it’s not clear that one is needed.

Firms would package home loans into bonds and Investors would buy them absent government guarantees, market participants said Friday. Mortgages would be more expensive, but only compared to today’s historically-low prices. Over time, they’d moderate to average levels, they said.

In effect, Democrats’ argument that the cost of mortgages would skyrocket lacks merit, they said.

“The notion that the cost of these products would be extraordinarily high is predicated on the notion that we continue to accept no down payments on loans,” said Joshua Rosner, managing director at independent research consultancy Graham Fisher & Co. and one of the first analysts to identify problems at Fannie Mae and Freddie Mac.

Brett D. Nicholas, the chief investment and operating officer at Redwood Trust, a California-based real estate investment firm, said that with taxpayers backing 95 percent of new home loans “there is no room for the private sector.”

“It’s a circular argument to say that, ‘Well, the private sector is not there so oh my God rates are going to go up hundreds of basis points,’” Nicholas said. “It’s just not true.” One basis point equals 0.01 percentage point.

“The fact is the private sector is there,” Nicholas added. “We have capital. Lots of firms like us have capital. There’s trillions of dollars of demand from life insurance companies, banks, [and] mutual funds.”

Last year, his firm sponsored the only private-sector security backed by new home mortgages and sold to investors. The deal contained more than $200 million worth of jumbo mortgages, industry parlance for home loans too big to be backed by the Federal Housing Administration, a government agency, or Fannie Mae and Freddie Mac.

“The dollars are there,” Nicholas said. “There’s just no loans to sell to [investors] because they’re all going to Fannie, Freddie and FHA.”

Rosner said that if borrowers start putting down 20 percent of the purchase price, investors would price in lower risks of default and snap up the securities.

He added that getting borrowers to put that much down is good for the economy because it gets consumers in the habit of saving more and only being willing to buy a home once they were sure they could afford it.

This would lessen the risk of a housing collapse and minimize costs to taxpayers, Rosner said, as opposed to the administration’s preferred approach of a continued government role, which he argues simply continues the current system of privatized gains and socialized losses.

“The administration is still not thinking of ways to incent proper behavior,” Rosner said. He added that the tax code could bring about many of his recommendations.

by Shahien Nasiripour Huffington Post February 11, 2011

Housing will gradually begin to recover in the second half of this year, David Goldberg, UBS’ home-building analyst, writes in a client note today. That assertion comes with 10 predictions for the year. (We’ll be happy to check back in 2011 and see how he did.)

- “Fundamentals will remain ‘choppy’ in the first half of the year, with conflicting data points making it difficult to ascertain whether we’ve actually reached the trough in housing.” We can’t argue with this one: Data points have turned into a roller coaster.

- “Headline risk, primarily driven by the government’s efforts to extract itself from the mortgage market, will drive the homebuilding stocks down 15% or more from current levels.” Mr. Goldberg continues: “With the longer term path for fundamentals offering limited clarity, we expect the homebuilding stocks to remain quite volatile and extremely sensitive to news flow.” We don’t need to remind investors how far they’ve already fallen from peak levels — or how they bounce around day-to-day!

- “The previous prediction notwithstanding, the government is going to do everything in its power to protect home prices.” Mr. Goldberg says: “In the end, we believe that concerns about higher rates and declining mortgage market liquidity won’t amount to much. In our opinion, the government has continually made it clear that it is working to limit further home price declines given the serious ramifications these declines would have for both consumers and lenders.” Read: Housing is too big to fail.

- “Although we forecast that as many as 7 million foreclosures are likely to occur over the next several years, we believe the pace at which these homes will come to the market will be consistent with current levels. As such, the concerns around the negative impacts of rising inventory levels are overdone.”

- “An improvement in unemployment is the single most important predictor for the longer term health of the housing market—only by focusing on this variable can we truly understand the timing for a recovery.” Yes, but when will jobs improve? Mr. Goldberg writes that UBS expects payrolls will start to recover in the first quarter, followed by a sharp rise in 2Q. Much of this will be driven by the hiring of temp workers, labeled a key forward indicator.

- “An improving jobs picture will drive greater price stability and better demand. That said, given the level of excess inventory, the pace of price appreciation will be below trend for some time.” So buy to live, not to flip for a quick buck.

- “The builders will see sequential improvements in their quarterly results.” They almost have to, given how the sector’s crash left them battered.

- “Given the limited amount of high quality, finished lots coming to market, we expect the builders to increasingly consider purchasing undeveloped parcels, which represent a greater value. This trend will be magnified if conditions start to accelerate more meaningfully in the near term as builders look to rebuild their operations over time.”

- “Although residential construction lending standards might loosen in 2010, liquidity will be insufficient to drive starts towards current consensus estimates.” Mr. Goldberg writes that lenders are reluctant to commit new capital to residential construction. Consensus for 800,000 single- and multi-family starts is “too aggressive,” he writes, putting the figure at between 700,000 and 720,000.

- “The longer term outlook for housing will increasingly dominate investors focus toward the end of 2010.” Does this mean even more obsessing over daily, weekly and monthly data? Perish the thought!

Readers, what do you think? Do you agree with Mr. Goldberg?

By Dawn Wotapka The Wall Street Journal January 14, 2011

Metro Phoenix’s foreclosure activity likely peaked in 2010.

The 2010 tally for pre-foreclosures, or notice of trustee sales, in the region is 79,637. That’s an 18 percent drop from 2009, when a record 97,141 were filed, according to Information Market, a real-estate analysis firm.

Foreclosures, known as trustee sales in Arizona, did tick up slightly in metro Phoenix to 49,808 from 47,992 in 2009. Last year’s foreclosure number is artificially low because of Bank of America’s two-month moratorium during October and November.

But the drop in pre-foreclosures is a positive sign for metro Phoenix’s housing market. Pre-foreclosures have been dropping steadily since July. December’s count of 5,475 is the lowest level for notice of trustee sales in the region since March 2008.

Lenders typically file a notice to foreclose after a homeowner is at least three months behind on payments.

The span between the trustee-sale notice being filed and the trustee-sale foreclosure has lengthened to several months because of loan modifications and lender issues.

Housing experts believe foreclosures will climb during the next few months as BofA works through its moratorium backlog.

But that shouldn’t impact pre-foreclosures and could inflate foreclosures for only a few months.

To declare 2010 the peak for foreclosures, notice of trustee sales need to keep falling during the next few months, and then foreclosures must follow with similar declines this summer.

Chase agreement

The Arizona Attorney General’s Office and Chase Home Finance have worked out an agreement that will help homeowners.

Chase has agreed to adopt a “borrower’s bill of rights” and pay $600,000 toward the state prosecutor’s efforts in helping homeowners in foreclosure.

The deal, reached late last week, calls for Chase to provide clear information on how to obtain a modification and avoid foreclosure; make decisions on borrowers’ modification requests within 30 days; stop home foreclosures during active loan-modification negotiations; and appoint one contact for each borrower seeking modification.

Former Arizona Attorney General Terry Goddard had been negotiating with BofA to commit to the borrower bill of rights, among other things, before suing the lender for mortgage fraud last month.

by Catherine Reagor The Arizona Republic Jan. 5, 2011 12:00 AM

There were 7,127 new and existing homes and condos sold during the month. Since 1994, home sales fell an average 7.3% from October to November in Phoenix. But this year’s gain shows some buyers are taking advantage of more affordable homes and historically low mortgage rates.

Still, Phoenix home sales remain down 16.6% from a year ago, taking median home prices down with it for the fifth consecutive month. Buyers paid a median $127,500 for all new and resold homes in November, down 10.7% from a year ago and down 1% from October. More than 36% of all homes sold for less than $100,000, up from 27% the year before.

The Phoenix market peaked in June 2006 when the median home price was $264,100. Prices have fallen more than 51% since.

REO sales of homes that had been

So far in 2010, nearly 55,500 homes were lost to foreclosure in Phoenix, up 6.2% from the same period last year.

Metro Phoenix home prices should hold steady this month but dip in December, according to the latest index from the Arizona Regional Multiple Listing Service.

The region’s median home price is projected to be $120,000 for November and then slip to $117,000 next month based on the home sales under contract tracked by the ARMLS Pending Price Index. If the median price falls below $119,000 next month, it will be a new 10-year low for the Valley and signal a double dip in prices.

The index is forecasting that Phoenix’s median will climb back to $120,000 in January but then drop to $105,000 in February. But the index is less accurate for months farther out. Many home sales that will close in February haven’t yet been negotiated.

Foreclosure resales and short sales are pulling down metro Phoenix’s housing values. In October, almost 65 percent of all the home sales in the area were foreclosures and short sales. But that number is down from September, when those distressed home sales made up a record 74 percent of all closings.

Growth think tank

Urban Land Arizona has a new executive director. Deb Sydenham has taken over for George Bosworth, a real-estate veteran who had led the group since 1996.

Sydenham was previously deputy director of P3 Initiatives at Arizona Department of Transportation. In that position, she was involved in building the state’s program to use public-private partnerships to work on Arizona’s transportation needs. Before that, she led community development and planning for the Arizona Department of Commerce.

Urban Land Arizona recently received a $25,000 grant to help support its Livable Phoenix project, which is working on promoting communities along the Metro light-rail system. Washington, D.C.-based Urban Land Institute awarded the grant to ULI Arizona.

Nominations for the group’s Arizona Smart Growth Award and Smart Growth Legacy Award are being taken at arizona.uli.org/Awards.aspx until Dec. 13.

by Catherine Reagor The Arizona Republic Nov. 17, 2010 12:00 AM

YouTube - Quantitative Easing Explained

Carlos Chavez/The Arizona Republic Scottsdale’s new council will face the issue of increasing building heights in downtown Scottsdale.

Carlos Chavez/The Arizona Republic Scottsdale’s new council will face the issue of increasing building heights in downtown Scottsdale.

When the new City Council is seated in January, the future of Scottsdale’s skyline will be in its hands.

Council members Wayne Ecton and Marg Nelssen will depart, and newly elected Linda Milhaven and Dennis Robbins will begin their terms.

The council will face a growing number of rezoning proposals that call for greater building heights within the downtown area, spurred by the downtown infill-incentive district and plan. The district allows buildings of up to 150 feet north of the Arizona Canal and surrounding the Scottsdale Healthcare Osborn Medical Center.

Gray Development Group is seeking approval for a two-building, luxury apartment complex near Camelback and Scottsdale roads, with at least one building close to 150 feet tall. That would match the AmTrust Bank building at 69th Street and Camelback Road.

The Blue Sky proposal has since been scaled back to a maximum height of 133 feet. The council has yet to consider the plan because of legal protests filed by surrounding property owners.

Other projects calling for greater heights in the downtown area have been filed with the city.

One calls for increasing the maximum height from 36 to 90 feet at Scottsdale Road and Angus Drive. Another proposes raising the maximum height from 36 to 65 feet on Scottsdale Road just south of the Arizona Canal.

Meanwhile, the owner of the Scottsdale Waterfront wants the final phases to include a building nearly 150 feet in height. The Waterfront is located in its own infill-incentive district.

“It’s all up to the council,” said Dan Symer, senior city planner, referring to those requests prompted by the downtown infill-incentive district.

“They can ask for additional heights and densities, and intensities,” he said of developers. “The community wanted a case-by-case analysis done. And if at the end of the day the council doesn’t agree that it’s a good application, it will deny it. Or if they think it is a good application, they will approve it. It all comes down to the (applicant) convincing the council.”

Defining council’s vision

Councilman Ron McCullagh would like the council to determine its vision for the city before considering proposals that would alter the skyline.

“The things that are being proposed right now pursuant to the infill-incentive district really aren’t relative, they’re extreme in their scale relative to the things around them,” he said. “And when you have that kind of a difference between what is proposed and what was ever contemplated, then you have really a difference in vision, not just a difference in policy and not just an issue of design or height.”

Councilman Bob Littlefield not only is against greater heights in the downtown area, but would like the council to eliminate the infill-incentive district and plan.

“I’m opposed to greater heights and density . . . because it’s inconsistent with what voters said they want downtown Scottsdale to look like,” he said. “It’s not downtown Tempe or downtown Phoenix, and to allow (greater heights and density) will simply make it look like those other towns.”

Nelssen has made it clear that she is opposed to greater heights and density in the downtown area. She also thinks Blue Sky is too high and dense, and that the project is not scaled correctly for the size of the parcel and the area.

Ecton hasn’t taken an official stand on building heights.

“We have to take into consideration both sides of the issue,” he said.

Chamber: Downtown evolving

A 2008 voters attitude study commissioned by the Scottsdale Area Chamber of Commerce showed 46 percent of respondents agreed that “to provide open space, parks and a people-friendly environment downtown, it is appropriate for the city to allow greater heights in return for a smaller building footprint so those amenities can be provided.” Thirty percent of respondents disagreed with the assertion.

According to chamber President and CEO Rick Kidder, there is “very strong” community support for greater building heights in the periphery surrounding downtown’s neighborhoods.

“We would be loathed to see height in the unique districts of downtown that make downtown so special,” he said. “But we also recognize that the periphery is emerging as an urban area . . . and is attracting young professionals and bringing in new talent. We need to provide housing options for that talent.”

Milhaven and Robbins would favor greater heights under the right circumstances and in the right locations.

“If you look at the downtown plan, it talks about having more people living downtown and I completely agree,” Milhaven said. “And all those areas they’re talking about are either on empty lots or on the edge. The historic part of downtown, I don’t see (where) there would be any changes there.”

Robbins said many people want to make sure Scottsdale maintains its character and doesn’t end up looking like Tempe or Phoenix.

“But I also think there are some places where height would work,” he said. “You certainly want to have increased activity and vibrancy throughout our downtown, and yet you don’t want to have a negative impact on those already here. So you have to be careful in how you allow certain things to happen.”

by Edward Gately The Arizona Republic Nov. 16, 2010 09:13 AM

Scottsdale proposals call for greater skyline heights

Low home-resale volume in October may be further evidence that faith in homeownership has declined in the Phoenix area, according to one Arizona State University analyst.

Sales of existing detached single-family homes usually taper off when the mercury falls each year, said ASU associate professor of real estate Jay Butler, but a significant decline in activity from the previous October supports the theory that many would-be homebuyers have lost confidence, though perhaps temporarily, in the benefits of owning a house.

The decline is at least partly the result of misgivings about homeownership, mortgages, lenders and the way foreclosures are carried out, he said.

“We keep getting hit with things like procedural errors in foreclosure . . . basically just enhancing people’s disbelief in the system,” said Butler, of ASU’s W.P. Carey School of Business.

Maricopa County home-resale activity in October declined by about 24 percent compared with a year earlier, according to Butler’s most recent monthly housing report, issued Monday.

There were 4,695 existing-home sales recorded in October, the report said, down from 6,140 sales in October 2009. Resale volume also decreased slightly from September, in which 4,895 sales were recorded in the county.

The median sale price in October for existing homes remained steady from the previous month at $135,000, according to the report. It was down just slightly from the median price of $140,000 in October 2009.

Given the negative reports about some lenders’ rapid foreclosure-processing methods, a national moratorium on foreclosure resales by Bank of America, and a pessimistic outlook on employment, Butler said he expects the median home price to drop even further than he had anticipated previously.

“Hopefully better,” he said about the housing market’s near future, “but I’m not convinced.”

Foreclosure activity in October was down from the previous month, Butler’s report said. There were about 3,400 foreclosures recorded in October, compared with 4,100 in September and 3,800 in October 2009.

Butler said the decrease could be due to fewer high-end-home foreclosures, but he concluded that lenders simply were delaying some of them because of the weak demand for such homes.

Foreclosures continued to account for about two-thirds of all housing-market transactions, Butler said, split about equally between new foreclosures and the resale of recently foreclosed-on homes.

by J. Craig Anderson The Arizona Republic Nov. 15, 2010 04:42 PM

Oct. home resales dip 24% from year ago

Your worldwide news source for mortgage, real estate, and financial news.

A monthly report shows the number of foreclosed homes in the Phoenix area edged up again last month, hitting the highest percentage of total sales since January. The Arizona State University Realty Studies report shows foreclosures made up 43 percent of the existing homes sold in July.

In June that number was 36 percent and in May, it was 33 percent. ASU real estate professor Jay Butler says the actual number of single-family home foreclosures was about 3,900, close to June’s numbers.

In July 2009, 4,200 homes were lost to foreclosures. Besides homes lost to foreclosure, 5,100 existing homes sold in Maricopa County in July, down from 6,900 in June and 7,300 in July 2009. That number includes homes previously repossessed by banks and then resold.

The Associated Press august 12, 2010

In an acknowledgment that the foreclosure crisis is far from over, the Obama administration on Wednesday pumped $3 billion into programs intended to stop the unemployed from losing their homes.

The housing market, which usually helps lead the country out of a recession, is this time helping hold the recovery back. Interest rates are at record lows, but too few can afford to buy or refinance. Unemployed homeowners who live in communities where values have fallen sharply are often unable to sell. Their foreclosures weaken neighborhoods and create a vicious circle by further undermining the market.

To try to break this pattern, the Treasury Department said it was adding $2 billion to its Hardest Hit Fund, roughly doubling its size. The fund, first announced by President Obama in February and expanded in March, goes to housing finance agencies in various states to create local aid programs.

Most of the state programs from the first two rounds are barely under way, but Treasury officials said it was clear that more funds were needed. “In this very deep recession, people have tended to be out of work a little longer,” Herbert M. Allison Jr., assistant secretary for financial stability, said. “That’s why we think this additional relief for people searching for a job is so important.” The second program, announced by the Department of Housing and Urban Development, will draw on $1 billion authorized by the new financial overhaul law.

The agency said it would work with local aid groups to offer bridge loans of up to $50,000 to eligible borrowers to help them pay their mortgage principal, interest, insurance and taxes for up to 24 months. The loans will be interest-free. Until now, the Hardest Hit Fund had been projected to help about 140,000 borrowers. Treasury officials said that number would grow with the new infusion of money, but offered no estimate. HUD also did not say how many homeowners would be eligible for its program.

If the new money is spent in the same way as the previous money, both programs would eventually aid about 400,000 borrowers — a large number, but not when set against the 14.6 million unemployed or three million contemplating foreclosure. Over the last two years, the government has deployed many programs to help housing. It pushed interest rates down, offered tax credits and set up an ambitious mortgage modification program. Yet housing remains feeble and seems poised after a brief respite this year to become weaker again. “I think all these government programs are helpful, but I wouldn’t look for them to cure the recession or even what ails housing,” said the economist Karl E. Case. “At best, they’re preventing things from getting much worse.”

The Hardest Hit Fund will draw on the $45.6 billion set aside for housing in the Troubled Asset Relief Program, the rescue measure begun at the height of the financial crisis in the fall of 2008. Initially, the fund gave $1.5 billion to five hard-hit states: Arizona, California, Florida, Michigan and Nevada. The second round in March of $600 million went to North Carolina, Ohio, Oregon, Rhode Island and South Carolina.

The expanded list of states eligible for the latest funding includes Alabama, Illinois, Kentucky, Mississippi and New Jersey, as well as the District of Columbia. Each state’s share of the money is based on its population. Many of the programs involve direct assistance. Ohio, for instance, said it would use its $172 million to aid 15,356 homeowners by helping bring delinquent mortgages current for owners experiencing hardship because of a loss of income. The assistance will last up to 12 months.

The other housing money in the Troubled Asset Relief Program is earmarked for the modification programs ($30.6 billion) and a Federal Housing Administration refinancing program ($11 billion). The administration can shift money between the programs only until Oct. 3, the two-year anniversary of the program. HUD said it was in the process of determining which communities would receive its money and how exactly the process would work.

“We’re still in the design phase,” said Bill Apgar, HUD senior adviser for mortgage finance.

by David Streitfeld New York Times august 11, 2010

by Adam Quinones on June 23, 2010

Fannie Mae announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure.

Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure.

“We’re taking these steps to highlight the importance of working with your servicer,” said Terence Edwards, executive vice president for credit portfolio management. “Walking away from a mortgage is bad for borrowers and bad for communities and our approach is meant to deter the disturbing trend toward strategic defaulting. On the flip side, borrowers facing hardship who make a good faith effort to resolve their situation with their servicer will preserve the option to be considered for a future Fannie Mae loan in a shorter period of time.”

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

Troubled borrowers who work with their servicers, and provide information to help the servicer assess their situation, can be considered for foreclosure alternatives, such as a loan modification, a short sale, or a deed-in-lieu of foreclosure. A borrower with extenuating circumstances who works out one of these options with their servicer could be eligible for a new mortgage loan in three years and in as little as two years depending on the circumstancesHere is the verbiage from the FN Bulletin:

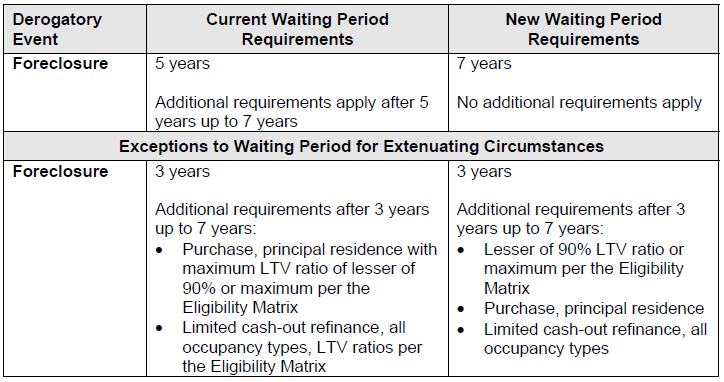

Currently, the waiting period that must elapse after a borrower experiences a foreclosure is seven years. However, Fannie Mae allows a shorter time period – five years – if certain additional requirements are met (e.g., minimum down payment and credit score, and occupancy requirements).

These requirements are being modified to remove the five year option. Unless the foreclosure was the result of documented extenuating circumstances, which only requires a three-year waiting period (with additional requirements), all borrowers will now be required to meet a seven-year waiting period after a prior foreclosure to be eligible for a new mortgage loan eligible for sale to Fannie Mae“

Don’t miss the section that says borrowers who have extenuating circumstances may be eligible for new loan in a shorter timeframe.

by J. Craig Anderson The Arizona Republic Jun. 24, 2010 12:00 AM

A small number of Arizona homeowners facing foreclosure could receive significant aid - reducing what they owe by $100,000 or more - under a state-run program approved Wednesday.

The Arizona Department of Housing got a green light from Washington, D.C., for a plan to use $125 million, its portion of federal funds allocated in February to help the nation’s hardest-hit housing markets.

Arizona’s program could slash mortgage balances for 1,850 households, three-fourths of them in Maricopa County.

The approach is far too small in scale to stabilize the state’s housing market, officials said. But they hope it will spur further action from government and lenders on cutting mortgage principal to keep homeowners in their homes. The plan would go much further than existing government efforts in its attempt to make mortgages affordable.

The state will issue borrowers loans of up to $50,000 to apply to their mortgage balances. Their lenders will be expected to match or exceed that amount.

These “soft” loans would not likely have to be repaid, at least not in full, under the terms of the plan.

Homeowners would have to repay portions of the loans if the home appreciated or was sold during a 10-year period.

The program also would:

• Give lenders incentives of up to $5,000 to settle second mortgages for up to 1,500 homeowners.

Those loans have complicated many borrowers’ attempts to modify their mortgage payments or complete short sales, in which they sell for less than what they owe but avoid foreclosure.

• Give up to $12,000 in temporary aid to as many as 1,000 households that have suffered reduced incomes.

The plan, dubbed “Save My Home AZ,” is expected to launch in September.

As a trial run for potentially broader mortgage-relief programs, state officials said, it will blaze into largely uncharted loan-modification territory.

“What we’re hoping is that, if it’s successful, Treasury would provide more funding for it,” said Carol Ditmore, the Housing Department’s assistant deputy director of operations.

But with as many as 50,000 foreclosures expected to occur in Arizona this year, Save My Home AZ’s direct impact would be minimal, officials said.

It also shares some of the drawbacks that have plagued other government-run housing-relief efforts. It imposes strict eligibility requirements, meaning many homeowners at risk of foreclosure won’t qualify for help.

And its biggest hurdle is that it relies on the optional participation of lenders to match the cuts in principal.

Big mortgage lenders including Bank of America, which holds a significant portion of Arizona’s troubled mortgages, have largely refused to reduce principal for borrowers seeking loan modifications.

MaryJane Rogers, spokeswoman for Chase Home Lending, a JPMorgan Chase & Co. subsidiary, said the company had not yet decided whether to participate in the Arizona program.

“We are committed to helping customers avoid foreclosure and are currently reviewing the details of the Arizona plan,” Rogers said.

Ditmore said the Housing Department has engaged in several discussions with BofA, the country’s largest mortgage lender, adding that bank officials have expressed their willingness to reduce loan principal for eligible participants.

BofA did not respond to phone and e-mail messages seeking comment Wednesday.

The program comes relatively late in the foreclosure crisis.

It is scheduled to conclude in June 2013, according to a proposal the state Housing Department submitted to Treasury officials earlier this year.

That’s around the time many housing experts expect foreclosure activity to return to a historically normal level.

The $125.1 million in funding is part of $1.5 billion in Treasury Department funds.

Shared with California, Nevada, Florida and Michigan, the funding is known as the State Housing Finance Agencies “Hardest Hit Fund.”

Treasury officials plan to distribute an additional $600 million to North Carolina, South Carolina, Ohio, Oregon and Rhode Island to help states with unemployment rates exceeding 12 percent.